Yesterday's increase in the Fed's refinancing rate from 1.75% to 2.00% was absolutely predictable, so it did not have any effect on the market. Moreover, the pound even slightly strengthened, although the data on inflation seriously disappointed, as shown its stabilization at 2.4%. However, producer price growth rates in the U.S. accelerated from 2.6% to 3.1%, which turned out to be better than forecasts. Hence, the growth of the pound is justified solely by the market's willingness to raise the refinancing rate. So now, the market will pay more attention to macroeconomic statistics. In the UK, retail sales are expected to accelerate from 1.4% to 2.4%, while in the US, they may slow from 4.6% to 4.4%. In addition, the US may continue to increase inventories, and commercial reserves should increase by 0.3%.

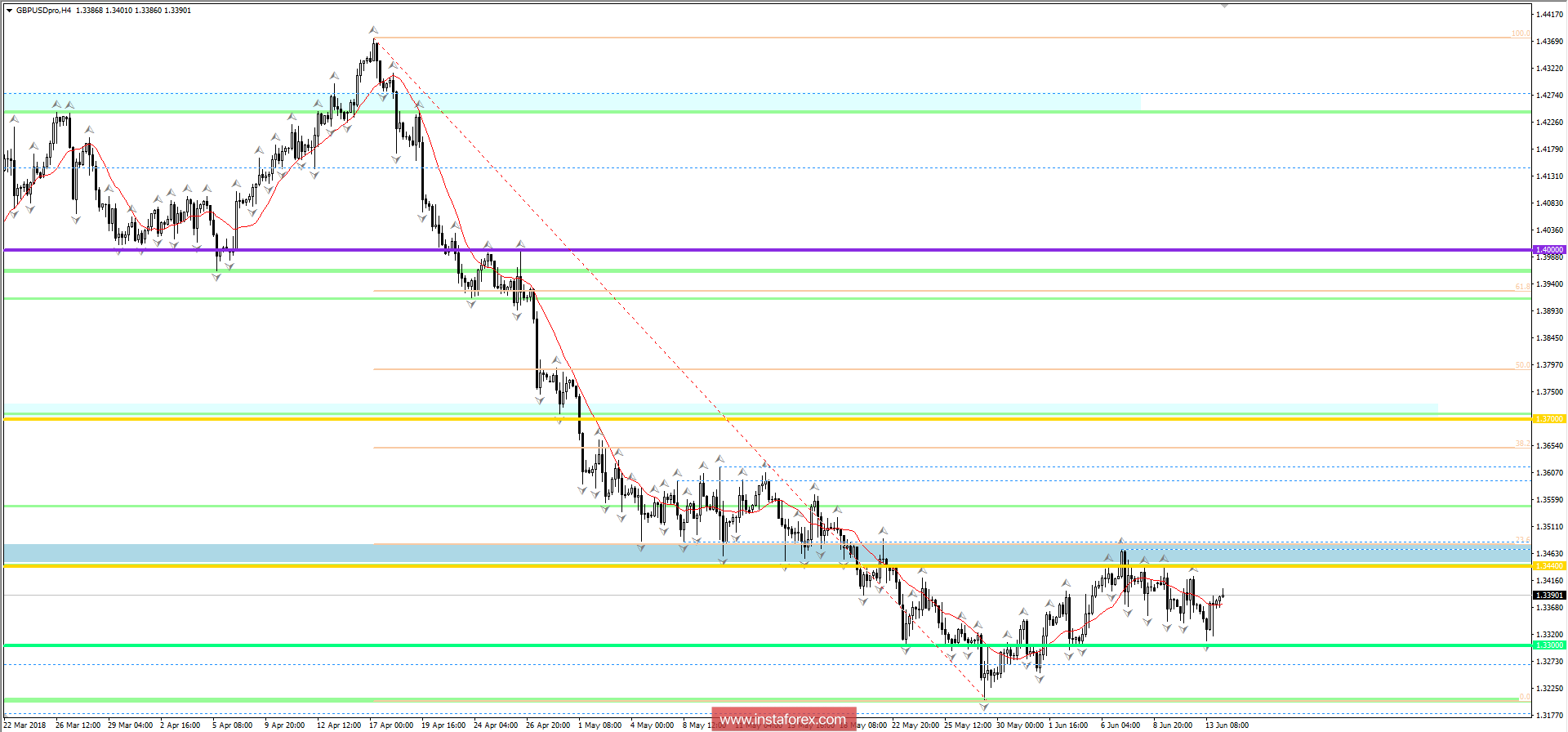

The GBP/USD currency pair is gradually recovering after testing the level of 1.3300. Most likely, we will again be attracted to the range of 1.3440, where we will slow down the movement.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română