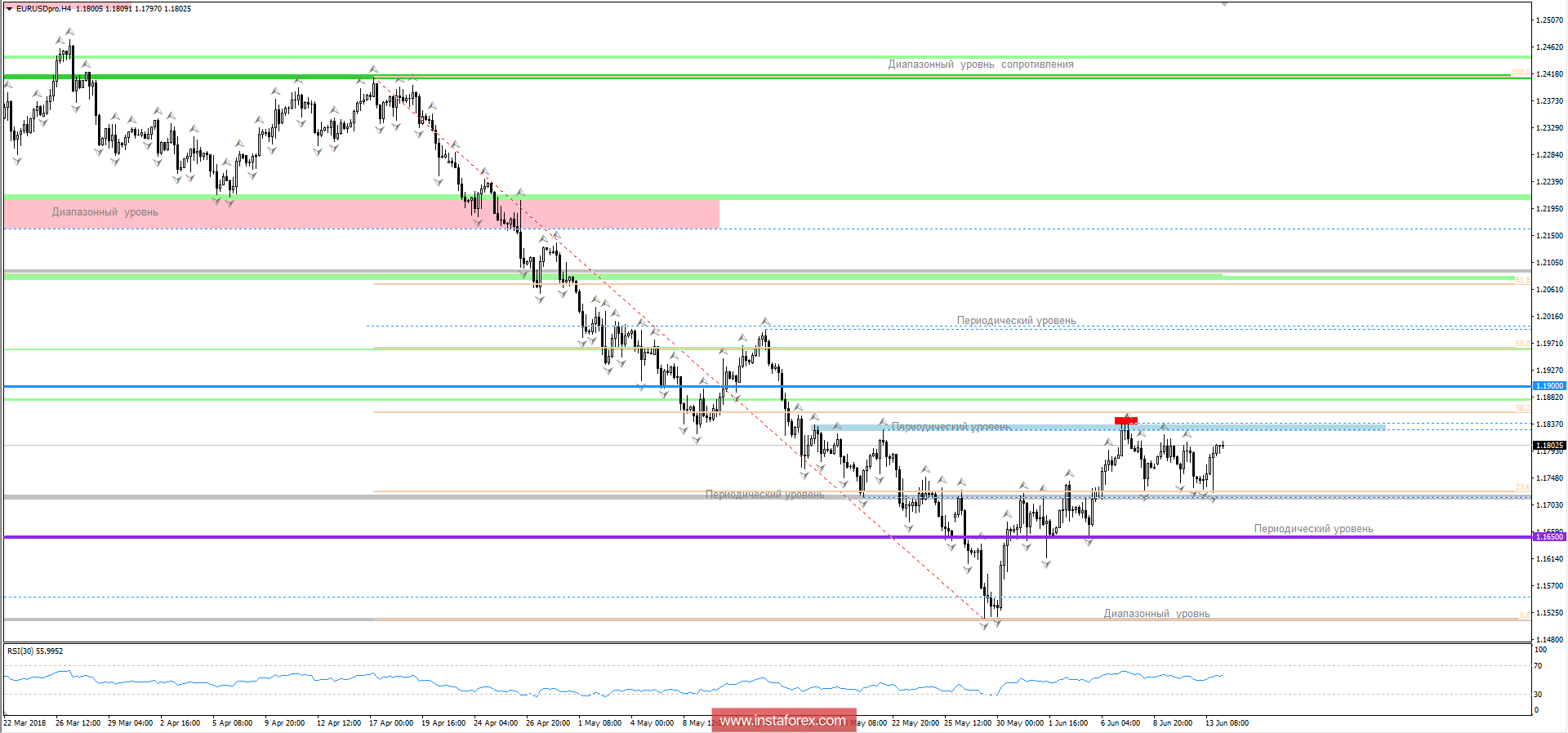

The EUR/USD currency pair continues the range wagering within the limits of 1.1725 / 1.1830. Yesterday's news background was unable to support the sellers. The Fed's interest rate statement was expected and the players did not support it, where in fact the linear analysis, in this case, worked perfectly, practicing the lower limit of 1.1725.

Further development:

Today, we are facing news from the EU, where traders are waiting for signals from the ECB on the reduction of QE, reminding you that the head of the Central Bank has already stated this. At the same time, there is also positive news from Italy, where she stated that she will not leave the European Union.

What can we expect:

While the movement in the range remains at 1.1725 / 1.1830, I would not place any positions. At the moment, it is most attractive to take a waiting position, the news background can provoke an unjustified chatter. However, the setting of pending orders can perfectly suit the current situation. We have two scenarios:

First - the news background played positively on the euro. In this case, we set the pending order above the upper limit. I would advise considering the point above the fractal at 1.1838 (from June 7, H4).

Second - News background will not hold bulls and all the actions are expected. In this case, the movement in the range will remain 1.1725 / 1.1830.

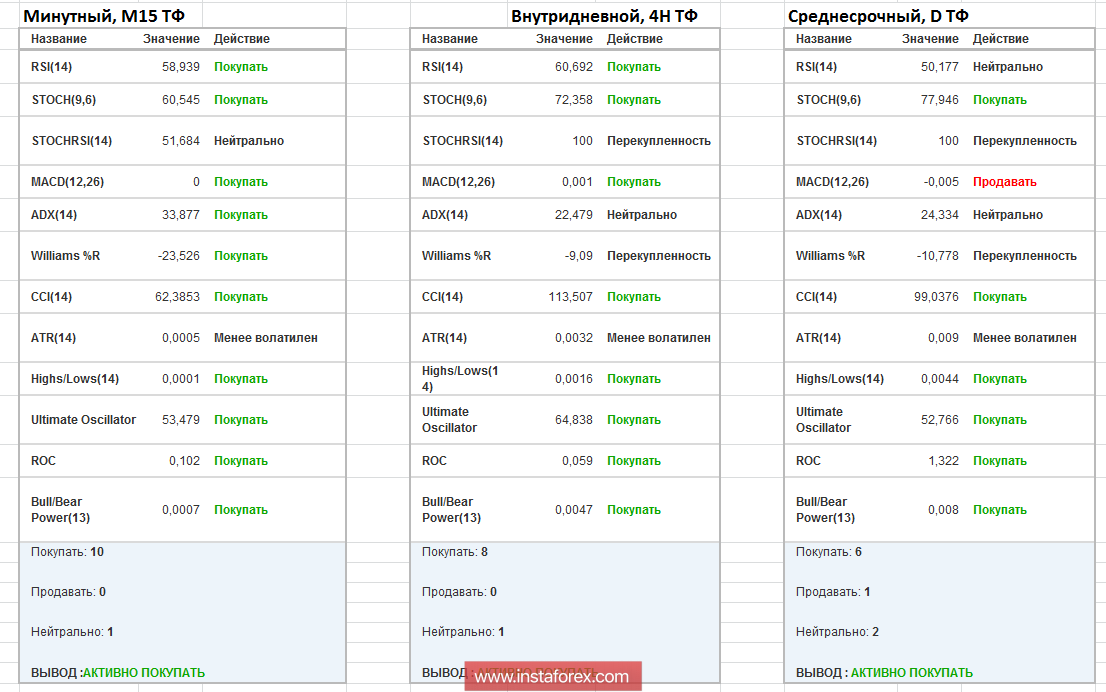

Technical picture:

Analyzing the different sector of timeframes (TF), we can see that indicator analysis is more inclined to buy than to sell.

CONCLUSION: ACTIVE BUY

Key Levels

Resistance zones: 1.1830 *; 1.1900; 1.2100

Support zones: 1.1725 *; 1.1650 *; 1.1540 **

* Periodic level

** Range level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română