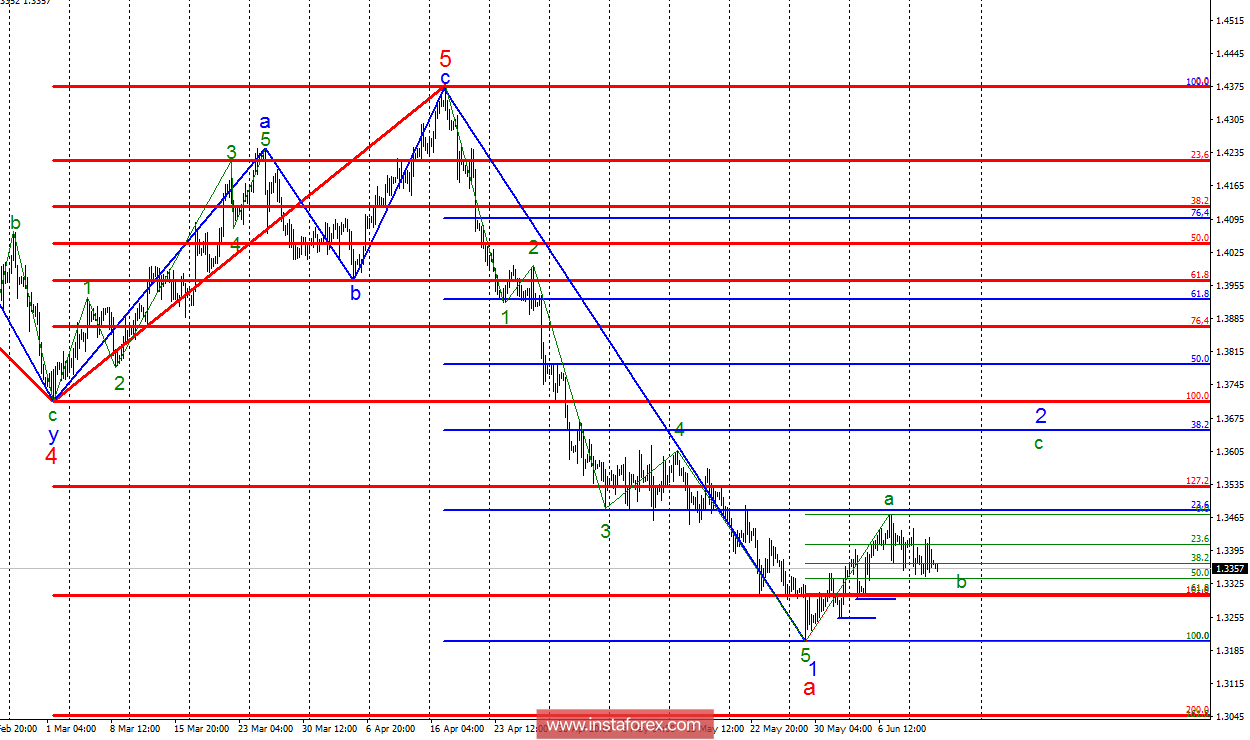

Analysis of wave counting:

During the trades on June 12, the GBP / USD currency pair lost a few more points and almost worked out the calculated mark of 1.3335, which equates to 50.0% of Fibonacci, constructed according to the size of the assumed wave a, 2. Thus, from the mark of 1.3335 or 1.3306 (61.8% Fibonacci), it is expected to resume the increase in quotations within the wave c, 2, with targets near the mark of 1.3651, which corresponds to 38.2% of Fibonacci. Near this mark, it will be possible to expect the resumption of the downward trend segment, which takes its start on April 17.

The objectives for the option with purchases:

1.3478 - 23.6% of Fibonacci

1.3528 - 127.2% of the Fibonacci of the highest order

1.3651 - 38.2% of Fibonacci

The objectives for the option with sales:

1.3045 - 200.0% of the Fibonacci of the highest order

General conclusions and trading recommendations:

The assumed wave 2, a, continues its construction. Now, the pair is at the stage of constructing the internal wave b, 2. About 33 figures, or slightly higher, I recommend starting new purchases of the pair with minimal targets near the mark of 1.3478, which is equivalent to 23.6% of Fibonacci, of the assumed wave c, 2. Stop Loss, I recommend setting below 33 figures in case the corrective set of waves turns out to be very shortened. I recommend returning to the sales of the pair no earlier than a successful attempt to break through the lows of June 1 and 4.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română