To open long positions for EUR / USD, you need:

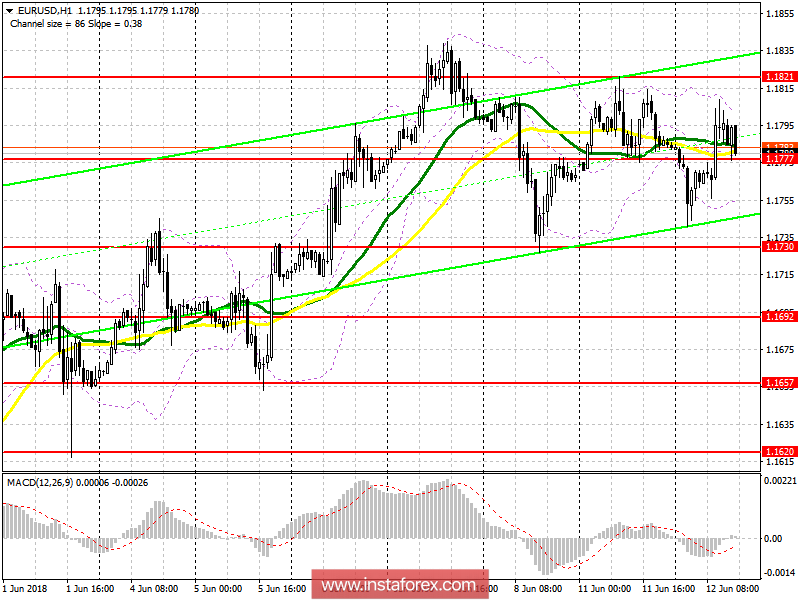

Buyers returned to the resistance level of 1.1777, which now serves as a support role. In the case of weak inflation data in the US, the demand for the euro may rise, which will lead to the renewal of the already larger area of 1.1821, the breakthrough of which will lead to highs around 1.1869, where I recommend fixing the profits. In the case of a decline in the euro in the afternoon, you can go back to the rebound on purchases from 1.1730.

To open short positions for EUR / USD, you need:

The return to the support level of 1.1777 will lead to a new wave of sales of the European currency, with the release to the lows of the day in the area of 1.1730 and the renewal of the area of 1.1692, where I recommend fixing the profits. To sell the euro can be on the rise only after the formation of a false breakdown at 1.1821 or a rebound from 1.1869.

Description of indicators

MA (average sliding) 50 days - yellow

MA (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA

Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română