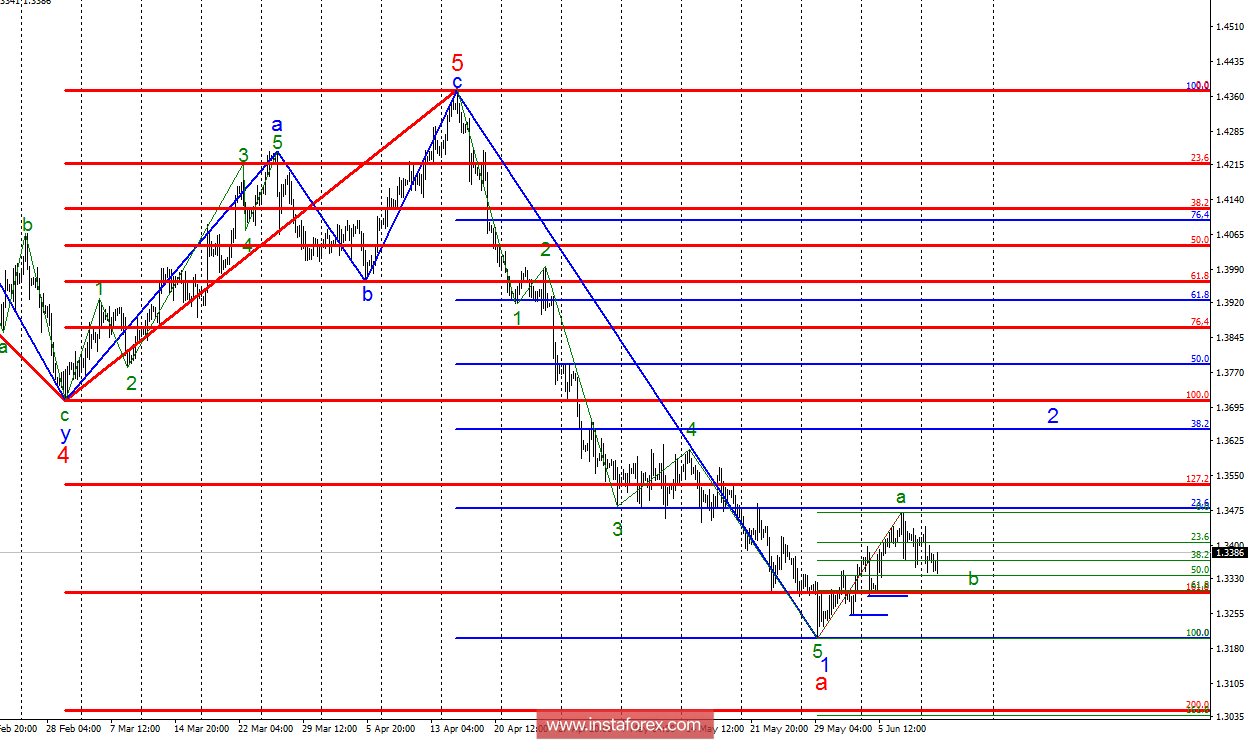

Analysis of wave counting:

During the trades on June 11, the GBP/USD pair lost about 70 basis points from the day's high. and began, thus, the construction of wave b in the composition of the future wave 2 of the downward trend section. If this assumption is true, then the decline in quotations will continue with the targets, which are about 33 figures. After the completion of wave b, a resumption of the increase in quotations within wave c, at 2, is expected with the targets located near the estimated mark of 1.3651, which corresponds to 38.2% of Fibonacci.

Targets for buying:

1.3478 - 23.6% by Fibonacci

1.3528 - 127.2% by Fibonacci of the highest order

1.3651 - 38.2% by Fibonacci

Targets for selling:

1.3045 - 200.0% by Fibonacci of the highest order

General conclusions and trading recommendations:

The assumed wave 2, in a continues its construction. Now the pair is in the formation stage of wave b, at 2. About 33 figures, counting on the completion of wave b, it is recommended to begin buying the pair with minimal targets near the mark of 1.3478, which is equivalent to 23.6% Fibonacci, constructed according to the size of the whole wave and the downward part of the trend. Return to the sales of the pair is recommended no earlier than a successful attempt to break through the lows of June 1 and 4.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română