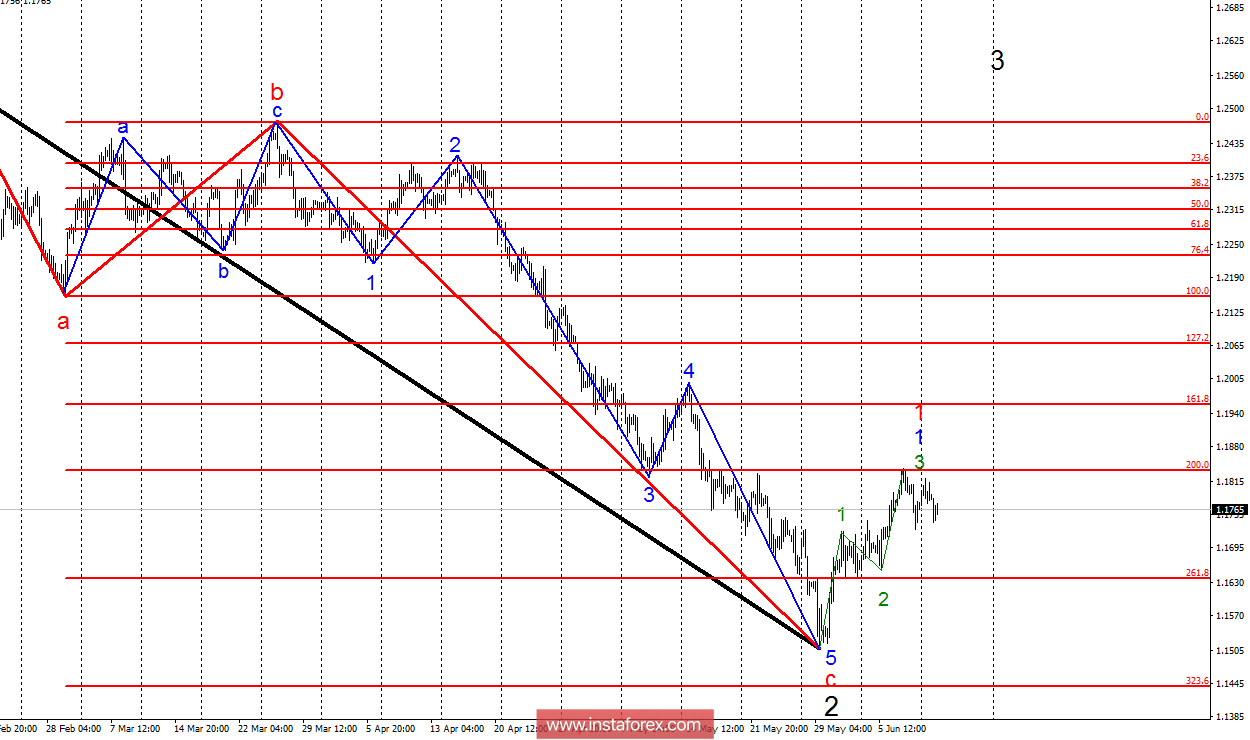

Analysis of wave counting:

During trading on Monday, the EUR/USD fell 40 basis points from the highs of the day, and this development fits perfectly into the scenario of constructing the correctional wave 4, in the composition of the future wave 1, in 1, in 3. If this assumption is correct, then after the completion of the construction of the internal wave c, at 4, the rise in quotations within the framework of wave 5 with targets above the estimated mark of 1,1837, which corresponds to 200.0% of Fibonacci. After the completion of the construction of wave 5, a decrease in the region of 17 figures is expected in the framework of constructing the corrective wave 2, at 1, at 3.

Targets for selling:

1.1700 - 1.1650

Targets for buying:

1.1958 - 161.8% by Fibonacci of the highest order

1.2070 - 127.2% by Fibonacci of the highest order

General conclusions and trading recommendations:

The EUR/USD currency pair is supposed to be within the framework of wave 4, at 1, at 1. Based on this, it is recommended to keep buying in order to build a wave of 5, at 1, at 1 with minimal targets near the mark of 1.1837. Successful attempt to break the mark of 1,1837 will lead to a further increase in quotations with a target of about 1.1958, which is equivalent to 161.8% of Fibonacci. During the construction of wave 5, at 1, at 1 it is recommended to reduce buying gradually, because after the completion of this wave, a decrease in the area of 17 figures is possible.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română