The British pound started an important week for itself on a minor note. The worst dynamics of industrial production in the last 5.5 years, the longest decline in the construction sector since 2013, the reduction in exports and the disappointing foreign trade statistics associated with it have lowered the GBP/USD quotations to the weekly lows. The chances of a November increase in the REPO rate dropped from 90% to 87%, and Pantheon Macroeconomics notes that it is senseless to blame bad weather, and expects further problems in the industrial sector.

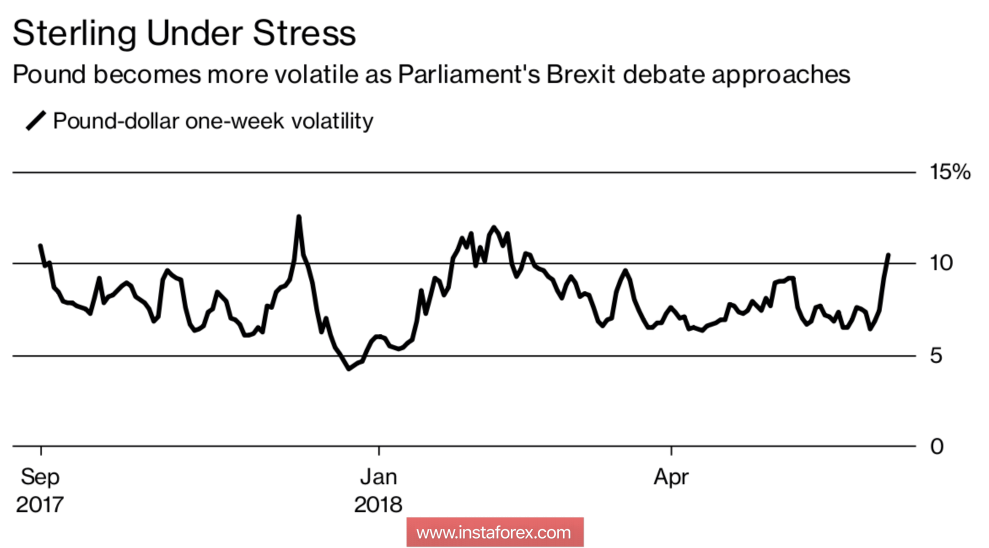

However, the insignificant reaction of the futures market to the macroeconomic statistics, which has seen the light of day, proves that the most important thing is yet to come. Sterling has to pass a test release of data on the labor market (June 12), inflation (June 13) and retail sales (June 14). On June 12, a vote will take place in Parliament on the changes in the legislation on Brexit. If the amendments manage to pass, it will be regarded as a mild scenario and will support the bulls for GBP/USD. On the contrary, a negative result will increase the risks of resignation of Theresa May from the post of prime minister. In any case, the growth of the pound's volatility on the eve of an important event indicates a return of political risks, which is a "bearish" factor for the sterling.

Dynamics of pound volatility

In my opinion, the key indicators, which should be closely monitored by investors, are inflation and average wages. The first because of the 52% rally of oil in the last 12 months, according to the median forecast of Bloomberg experts, risks to accelerate the indicator from 2.4% to 2.5% y/y. It will accelerate more-the probability of the November increase in the REPO rate will increase, and the "bulls" on GBP/USD will go into a counterattack. The fact is that consumer prices have recently been growing in many countries of the world due to oil, including the eurozone and Japan that do not shine before. I do not think that the UK will become a black sheep.

With regard to average wages, their acceleration from the current 2.9% (without premiums) and 2.6% (taking into account premiums) will increase the purchasing power of the population and will contribute to the recovery of GDP in the second to third quarters. In an environment where unemployment has been hovering near the lowest levels over the past few decades, inflation is reversing from a 2% target and is rising, and the economy is recovering, the Bank of England has no other options how to raise the repo rate. Another thing is that there are two monetary units in any currency pair, and improving the FOMC's forecasts for the federal funds rate and inflation at the end of the June meeting of the regulator can restore investors' interest to the US dollar.

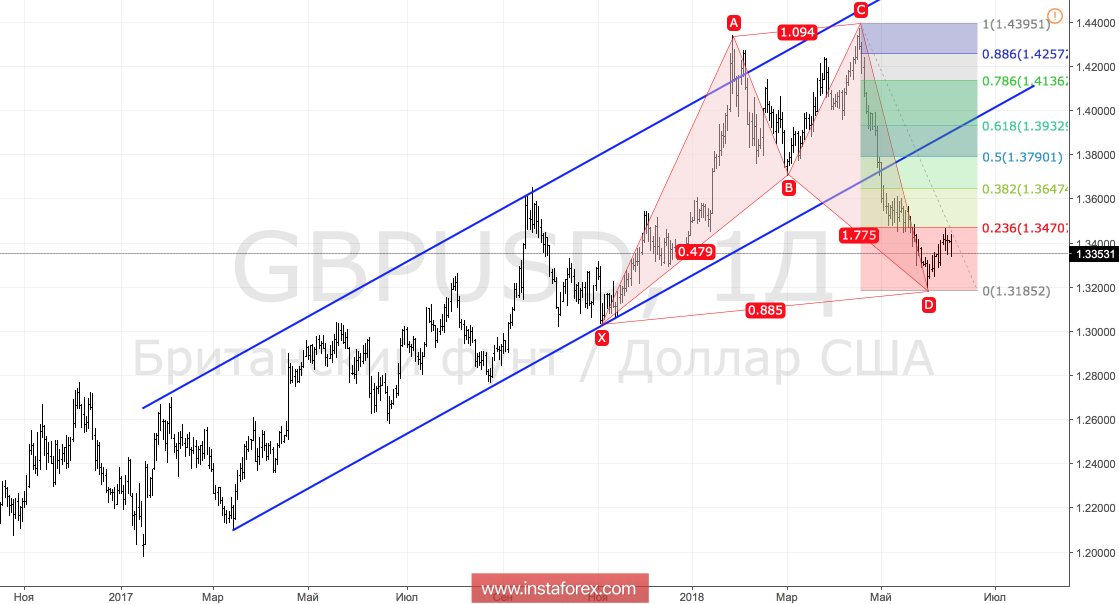

Technically, after reaching a correction level of 23.6% of the wave of the 5-0 pattern, the "bears" in the GBP/USD went counter-attack and are trying to restore the downward short-term trend. A necessary condition is the renewal of the May lows. On the contrary, a confident assault on the resistance at 1.347 will increase the risk of retracement to 38.2% and 50%.

GBP/USD, daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română