GBP/JPY

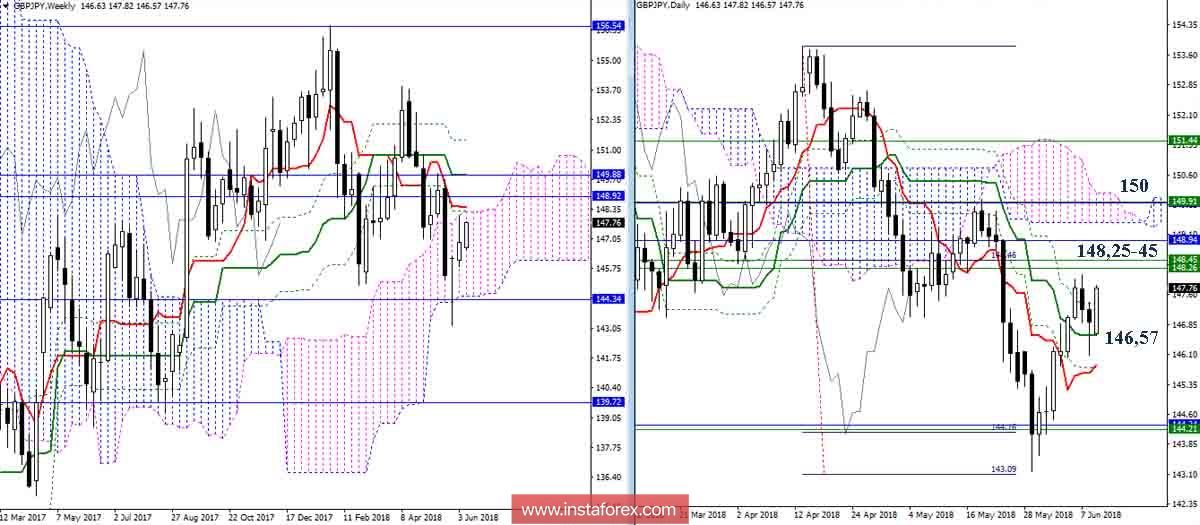

On Friday, during the retest of the passed levels of the day cross (Kijun 146.57), the pair formed a retreat. At the moment, there is a development of the situation and the strengthening of bullish positions. The nearest resistances are now concentrated in the area of joining forces of the weekly levels – 148.25-45 (Senkou span a + Tenkan + Fibo Kijun). The break and consolidation above will allow to consider new prospects. The most important task will be to test the area 150 (daily cloud + weekly Kijun + monthly Tenkan).

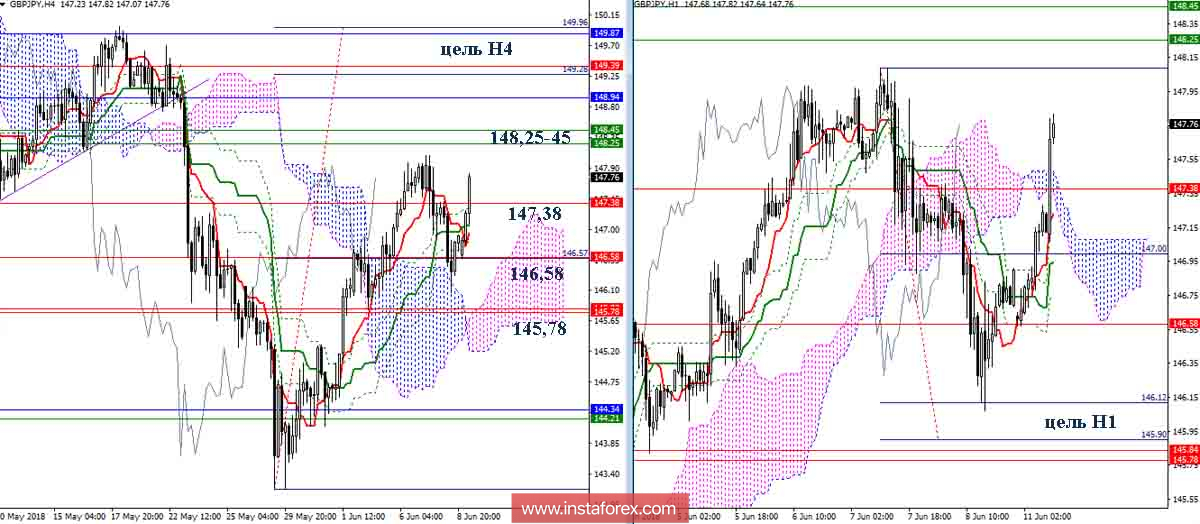

At lower time intervals, the bears, with a decrease, worked on the first target, the target for the breakdown of the H1 cloud (146.12), but at the same time the work capacity of the upward target for the breakdown of the H4 cloud was preserved. As a result, the recovery of the uptrend and the overcoming of resistance 148,25-45 will allow to consider the possibility of fulfilling the goal of H4, which will lead players to increase to the daily cloud and the accumulation of resistance in the area of 150. Support today should be noted at 147.38 - 146.58 - 145.78.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română