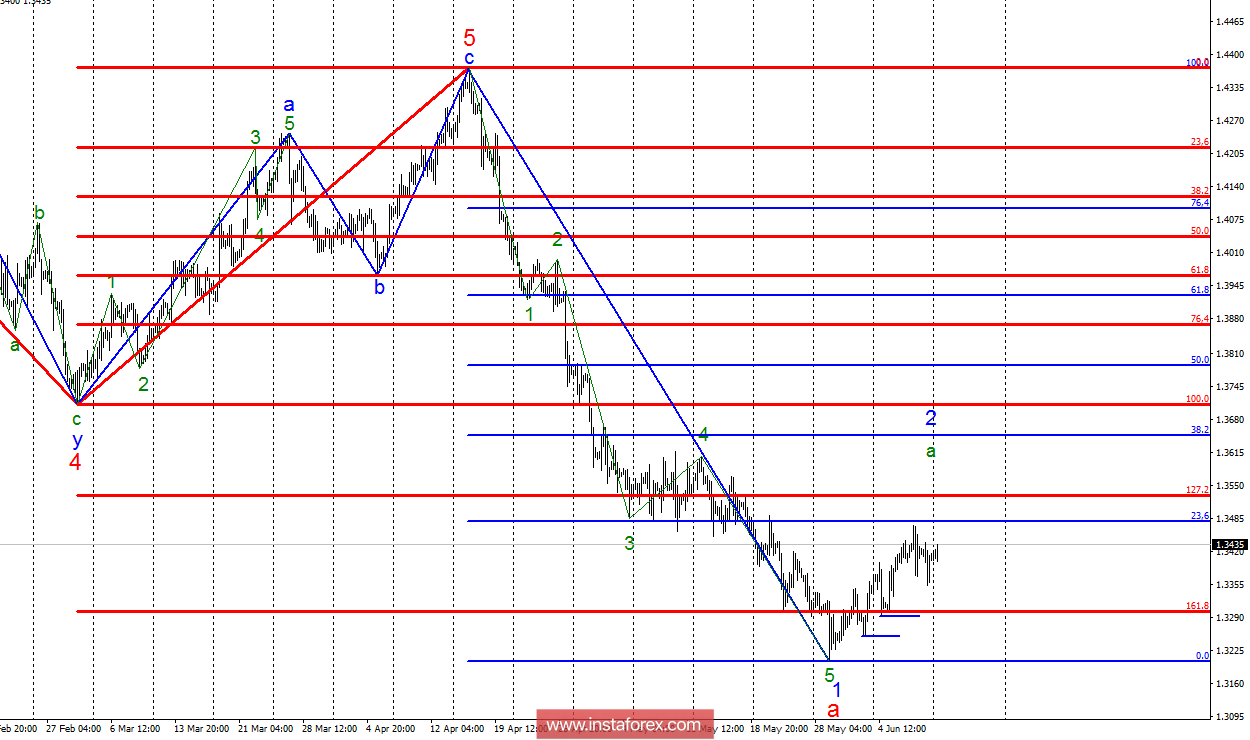

Analysis of wave counting:

During the trades on June 8, the GBP/USD pair moved in different directions, ending the day with a drop of just a few points. Thus, the construction of the corrective wave a, in 2 continues with the first target of 1.3478, which corresponds to 23.6% Fibonacci, with the prospect of reaching 1.3651. Local lows from June 1 and 4 support the rise in quotations and formation of wave a. A successful attempt to break through the level of 1.3478 will show the market's readiness to further increase of quotations. It is possible to wait for the resumption of the downward trend part of the trend not earlier than the end of wave 2 or the break of the lows from May 29.

Targets for buying:

1.3478 - 23.6% by Fibonacci

1.3528 - 127.2% by Fibonacci of the highest order

1.3651 - 38.2% by Fibonacci

Targets for selling:

1.3045 - 200.0% by Fibonacci of the highest order

General conclusions and trading recommendations:

The assumed wave 2, in a becomes more persuasive, and the increase in quotations is most likely to continue. Thus, it is recommended to buy in small volumes (since the wave is still correctional) with targets located near the markers 1.3478 and 1.3651. It is recommended to return to selling if the pair makes a successful attempt to break the low of May 29, with targets below 1.3045.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română