The euro fell significantly in the morning and remains under pressure after good growth throughout the week. Traders could record profit before the weekend, as the G7 summit can present a number of surprises that will negatively affect the course of the European currency.

As noted in the morning review, the main agenda will be trade relations. The trade conflict that erupted after the United States introduced import duties on steel and aluminum against Canada and the European Union could trigger retaliatory tariffs on American goods, which would lead to even greater contradictions and exacerbation of trade relations.

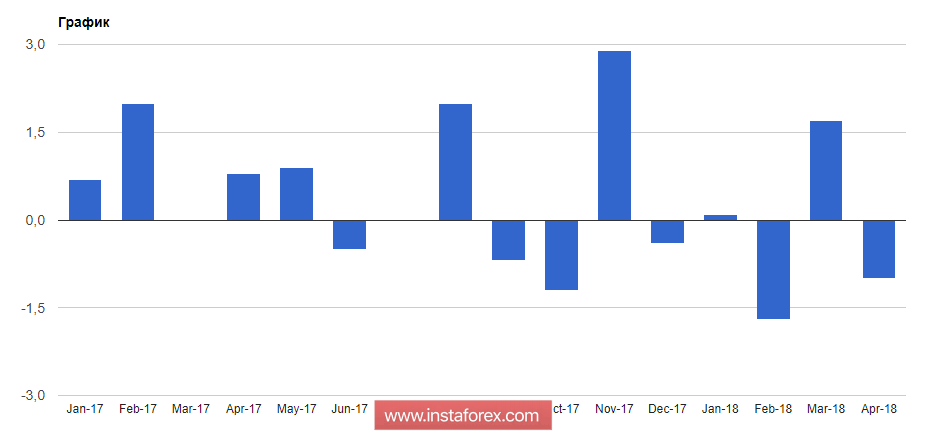

Today a report from the Federal Bureau of Statistics of Germany was published, which did not please with its indicators. According to the data, industrial production in Germany in April this year decreased by 1.0% compared with March. Exports fell by 0.3%. These data, along with the weak statistics that came out earlier this week on Germany's foreign trade, are still overshadowed by hopes for a faster recovery in economic activity in the second quarter of this year.

In France, too, with a similar indicator, everything is not very good. According to the report, industrial production in France in April this year fell by 0.5% compared with March. Economists expected production to increase by 0.3%.

Before the beginning of the G7 summit, the French Minister of Finance announced that the Merkel reform plan is an important step, but it will take a long way to reach agreement with Germany on reforms in the euro area. Here we are talking about European integration, whose opponents are concentrated in Italy, after the recent formation of the government.

Bruno Le Maire also drew attention to the fact that the eurozone should have a common budget. The Minister of Finance was not afraid to reproach the US for the decision to introduce trade duties, saying that they did not respect weakness, and in response to this, more drastic measures were needed.

As for the technical picture of the EURUSD pair, such a significant reduction is not surprising given the data and upcoming events. The main support levels will be located in areas 1.1730 and 1.1690, below which it is unlikely to break through to sellers today.

The Japanese yen, despite weak data on the economy, has grown in response to the demand for safe haven assets that protect investors from excessive volatility.

According to the report, Japan's GDP from January to March this year fell by 0.6% year on year. The data fully coincided with the preliminary estimate published earlier. Investments of private sector companies increased by 0.3% compared to the previous quarter.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română