To open long positions on EURUSD it is required:

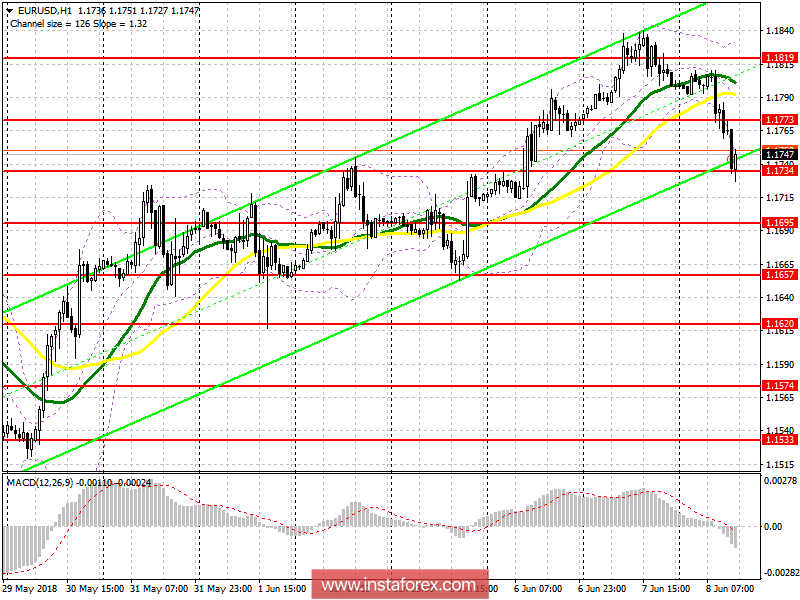

Buyers expectedly retreated, and now the entire calculation is at support level 1.1734. While the trade is above this range, a correction to the resistance area 1.1773 is quite realistic, and a break above will quickly lead to a return to the area of the highs of the day with an update of 1.1819, where it is recommended recording profits. In the event of a further decline in the euro, buying can be made on the rebound of 1.1695.

To open short positions on EURUSD it is required:

Repeated test of 1.1734 may lead to breakdown and consolidation, which will cause a sellout of the euro to the support area 1.1695, where it is recommended recording profits. In the case of an upward correction in the afternoon, selling can be made on a false breakout from 1.1773 and on a rebound from 1.1819.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română