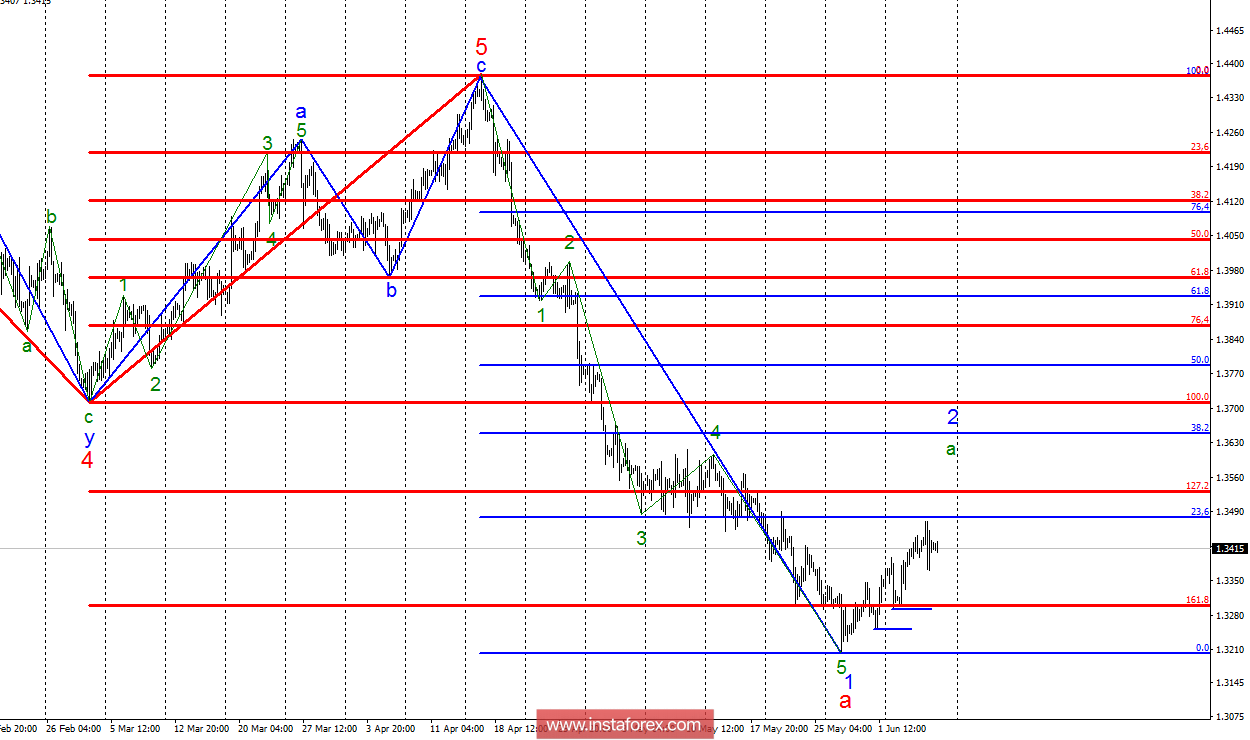

Analysis of wave counting:

During the trades on June 7, the GBP/USD pair added just a few points, but in the moment the estimated mark of 23.6% on Fibonacci was almost reached. Wave a, at 2 still does not look complete and fully staffed. Its first target is located near the estimated mark of 1.3478. Only strong fundamental news not in favor of the British currency can force the markets to move to selling of the pound without working out the target level. This option cannot be ruled out either. If there is no further upheaval for the British currency, then its recovery will continue.

Targets for buying:

1.3478 - 23.6% by Fibonacci

1.3528 - 127.2% of the Fibonacci of the highest order

1.3651 - 38.2% by Fibonacci

Targets for selling:

1.3045 - 200.0% on the Fibonacci of the highest order

General conclusions and trading recommendations:

The assumed wave 2, in a acquires a more convincing appearance, and the increase in quotations may continue. Thus, it is recommended to continue buying the pair of small volumes with targets located near the markers 1.3478 and 1.3651. It is recommended to return to selling if the pair makes a successful attempt to break the low from June 1, as it will warn of the inclination to complicate the proposed wave 1, but with the targets located near the 1.3045 mark, which corresponds to 200.0% of the Fibonacci senior order.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română