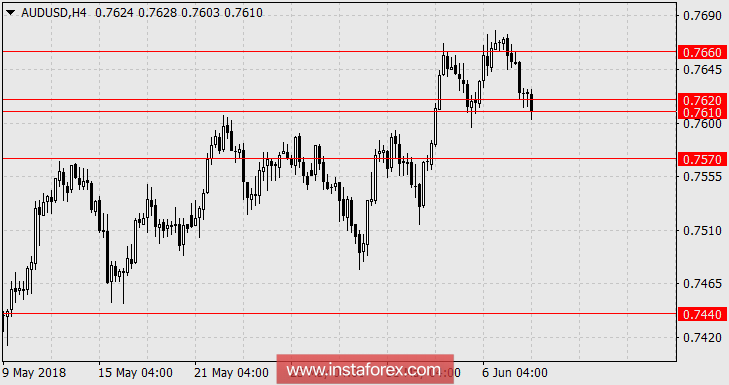

AUD / USD

As expected, the Australian dollar could not grow under the constant verbal pressure of RBA officials and the foreign markets. But the pessimistic data on the national trade balance were added. The data released yesterday showed zero growth in imports for April, with 2% drop in exports. As a result, the trade balance worsened from 1.731 billion dollars (revised from 1.527 billion) to 0.977 billion. The forecast assumed a decrease, slightly less up to 0.980 billion dollars. The index of activity in the construction sector from AIG last month fell from 55.4 to 54.0.

Today, Japanese GDP data and the balance of payments came out. Their weakness was reflected in all areas of the APR. The final assessment of the GDP for the 1st quarter remained at the level of the previous estimate of -0.2% against the expectation of an upward revision to -0.1%. The balance of payments in April came at 1.89 trillion yen against the forecast of 2.10 trillion. Bank lending for May fell from 2.1% YoY to 2.0% YoY against expectations of growth to 2.2% YoY. The Japanese index Nikkei 225 loses 0.21%, while the Australian S&P / ASX 200 -0.09%. Iron ore in the last day fell by 1.06%, aluminum by -1.5%, and copper added 1.6%. Meat futures in the price mostly lost.

We are waiting for the decline of the Australian dollar to 0.7440.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română