To open short positions on EURUSD it is required:

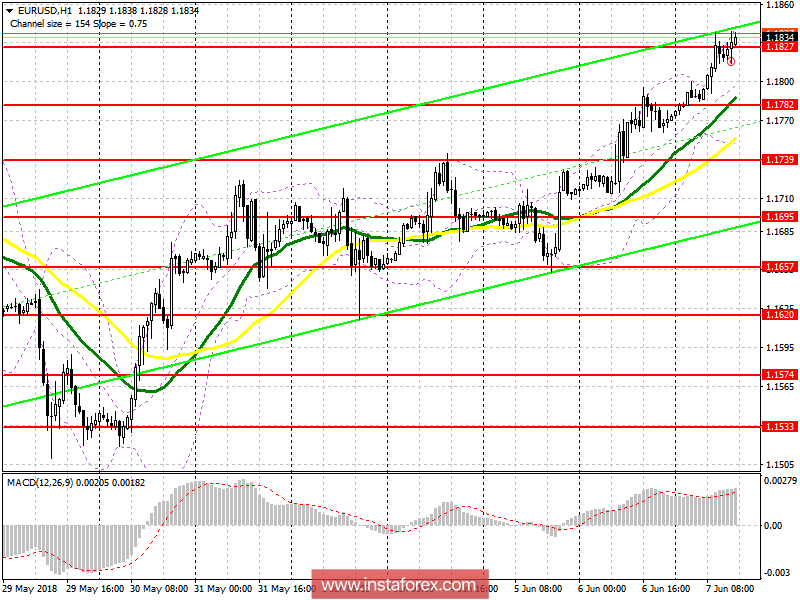

Buyers made the first attempt to gain a foothold above the level of 1.1828, but did not do it in the morning. However, while trade is in this range, the chance of further upward movement to the area of new monthly highs of 1.1875 and 1.1923 remains quite high. It is there that it is recommended to record profits. In the case of a decline in the euro in the afternoon, long positions can be estimated from support levels 1.1780 and 1.1739.

To open short positions on EURUSD it is required:

In case of another unsuccessful attempt to consolidate and return to the level of 1.1828, the pressure on the euro will increase, which will come to a quick descending correction to the area of 1.1782 and 1.1739, where it is recommended recording profits. In the case of continued growth on the trend, selling can be sought in the area of 1.1875 and 1.1923.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română