Eurozone

The euro continues to recover against the backdrop of a re-evaluation of the ECB's plans to normalize monetary policy.

The chief economist of the ECB, Peter Praet, said on Wednesday that the ECB will begin discussing the curtailment of the asset repurchase program at a meeting in a week. Earlier, members of the ECB leadership shied away from voicing any specifics on this issue, and the consensus opinion of the market was that the discussion would begin no earlier than the July meeting. Praet changed the accents, which means that on June 14 there will be new benchmarks for the euro.

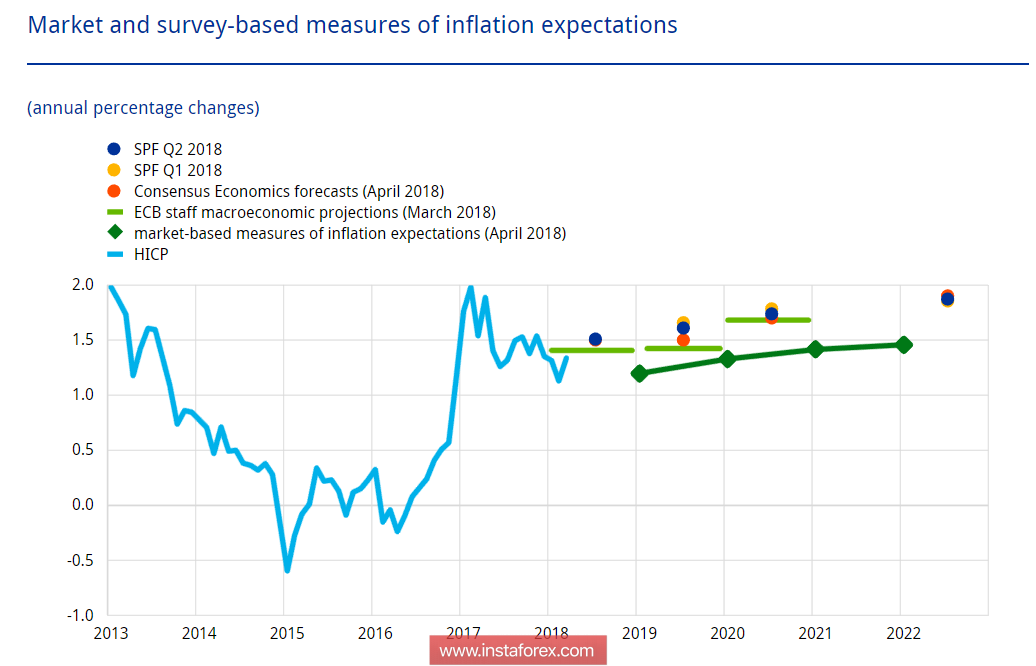

Comments from the ECB's top officials were expected, as the regulator noted in the May economic bulletin, both market and estimated indicators of long-term inflation expectations remain unchanged and suggest a gradual move to 2%.

The risk of deflation remains low, prices for residential real estate in the euro area are growing, the growth rate of the average wage by the end of 2017 and in 1 sq. km. in 2018 also became higher, which in general gives a rather favorable picture of price expectations and deprives the ECB of the opportunity to delay the issue of rates.

Some threat came from the general slowdown of economic activity in the euro area, but this factor was predicted after two years of active growth, and secondly, it was short-lived. Recent polls from Ifo and Markit indicate that business activity again began to grow.

Thus, the June meeting of the ECB may shift the focus on the issue of the dynamics of the EURUSD. The emerging growth of the euro was considered until recently as a short-term correction, but now there is every reason to believe that the euro formed the basis and begins the growth phase. Until the end of the week, the EURUSD rate can rise to 1.1870.

United Kingdom

The pound is recovering both against the background of a correctional decline in the dollar and in response to macroeconomic data that are quite positive from the beginning of the week. Business activity in the construction sector in May stayed at 52.5p (it was forecasted to decrease to 52p, but the positive added the refusal of the Bank of England to raise the rate last month). In the services sector, there was a growth to 54p where 53p was forecasted. Retail sales increased significantly according to the BRC version where in May, the growth was 2.8% vs. -4.2% a month earlier.

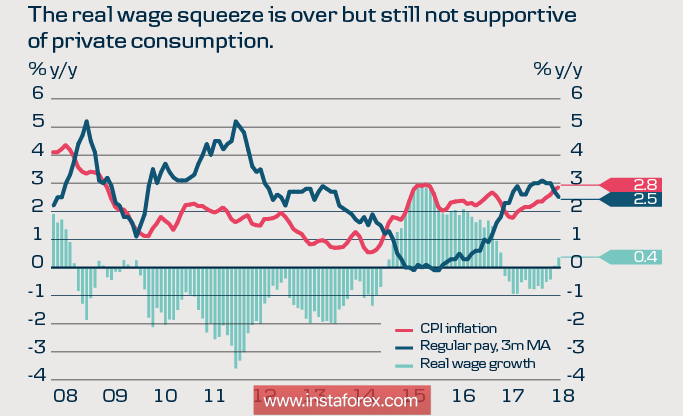

At the same time, the growth of the pound, in contrast to the euro, runs the risk of ending much earlier. We can not ignore the slowdown in economic growth in the UK, as well as the threat of lower inflation. The effect of the fall of the GBPUSD after the referendum is over, and consumer demand is under threat because of the low level of real wages.

After the meeting of the FOMC and the ECB in the middle of next week, attention will be shifted to the EU summit, wherein significant issues of Brexit will be discussed. Until then, the pound can feel confident, but then the decline may resume.

Until the end of the week, the pound will try to rise a little higher, with the attempt to likely reach 1.3550.

Oil

The reaction of oil futures to the bearish report on reserves in the US was short-lived. A small decline was immediately redeemed again, which indicates long-term bullish sentiment among players. Before the OPEC meeting in late June, oil is likely to remain within the limits of trade ranges, which for Brent are 74.30 / 77.30 dollars per barrel.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română