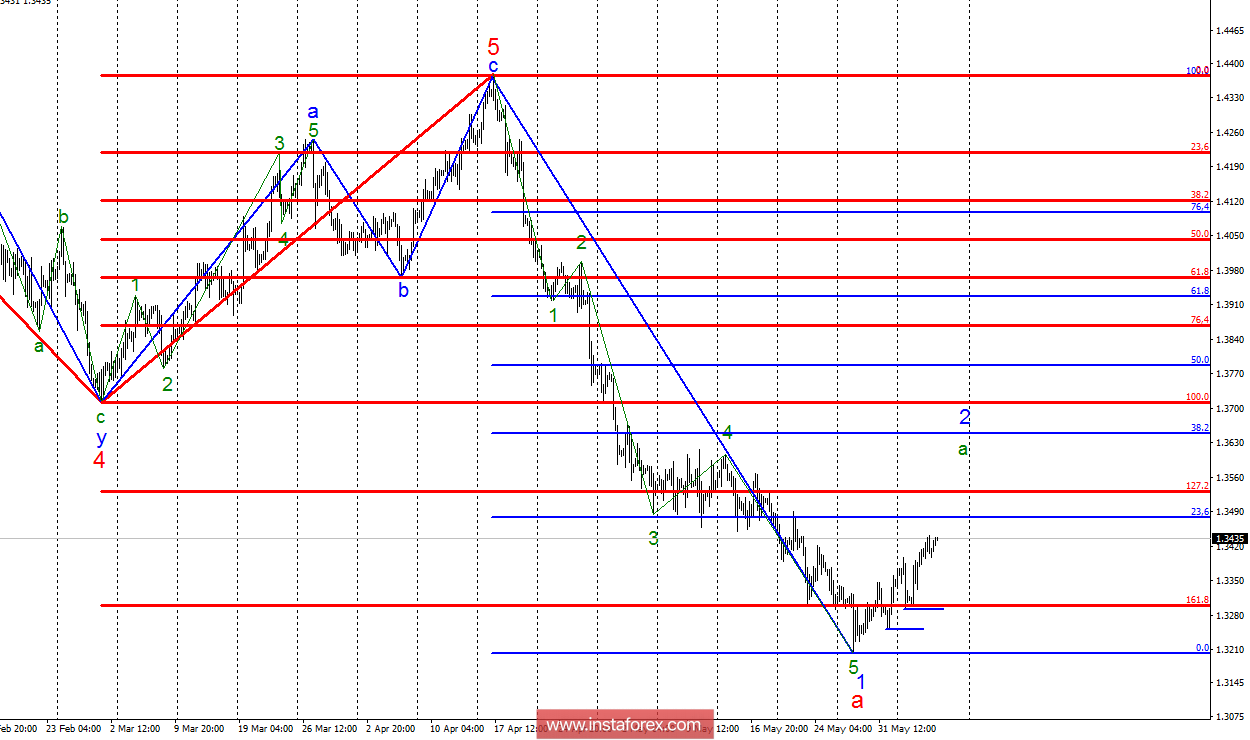

Analysis of wave counting:

During the trades on June 6, the GBP / USD currency pair added only 20 percentage points, but stayed within the framework of the proposed wave a, 2. Thus, the first settlement target for the instrument remains unchanged, 23.6% Fibonacci of wave 1. Two lows, from June 1 and June 4, form support levels, the breakthrough of which can return the pair to the construction of a downtrend section of the trend and the complication of the proposed wave 1, a. An unsuccessful attempt to break through the 23.6% mark may lead to the withdrawal of quotations from the peaks reached, but the wave 2, a, targets are located at a minimum around the estimated mark of 1.3651, which corresponds to 38.2% of Fibonacci.

The objectives for the option with purchases:

1.3478 - 23.6% of Fibonacci

1.3528 - 127.2% of the Fibonacci of the highest order

1.3651 - 38.2% of Fibonacci

The objectives for the option with sales:

1.3045 - 200.0% of the Fibonacci of the highest order

General conclusions and trading recommendations:

The assumed wave 2, a, becomes more convincing, and the increase in quotations continues. Thus, I recommend buying a pair of small volumes with the first goal, located near the mark of 1.3478. I am recommending sales if the pair makes a successful attempt to break the minimum from June 1, as it will warn of the pair's readiness to complicate the wave 1, but with the first targets located near the 1.3045 mark, which equates to 200.0% of Fibonacci of the highest order.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română