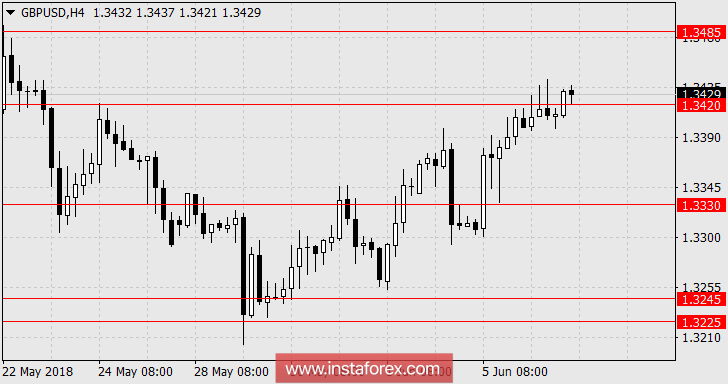

GBP / USD pair

The British pound grew slightly yesterday by 19 pp, following the euro's growth. The words of a member of the BoD Committee of the Bank of England, Ian McCafferty, with hints of the regulator's ability to even more soften the monetary policy "in case of an economic downturn.", look pessimistic for the "bulls". Under the economic downturn, investors understand Britain's exit from the EU without a trade agreement or with a bad agreement and the Economic data on England was not good yesterday. There will be an index of prices for residential property to be released today from Halifax for the last month with a forecast of 1.1% against -3.1% in April. Also tomorrow, there will be secondary data on consumer sentiment.

On Monday, the U.K. data on industrial production and construction will be released. The forecast is still on the volume of construction with the expected decline on the forecast to -5.7% y/y (-2.2% m/m) from -4.9% y/ y. Thus, the pound simply has no reason to grow before the Fed meeting. We are waiting for the price of 1.3330.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română