The euro rose today, gaining support not from rumors about the curtailment of the quantitative easing program by the ECB, but already because of official statements made by representatives of the Central Bank.

Today, the chief economist of the ECB, Peter Pret, pointed out that the leaders of the Central Bank are practically confident in the return of inflation in the euro area to a target level of just below 2.0% in the near future. Pret sees new signs of accelerating the growth of wages in the euro area, which in the future will spur the economy to growth, and will also lead to a more powerful inflationary momentum.

Let me remind you that at the beginning of this year, after a series of weak data indicating a slowdown in economic growth, the ECB representatives made a number of assumptions, including the postponement of the curtailment of the asset repurchase program, which was scheduled for September of this year.

Now such fears have become less likely, and despite the recent slowdown in economic growth, as well as political instability in Italy and Spain, the ECB may still resort to curtailing the quantitative easing program under which the Central Bank buys assets of 30 billion euros per month.

Data in the afternoon on the US economy exerted even more pressure on the US dollar.

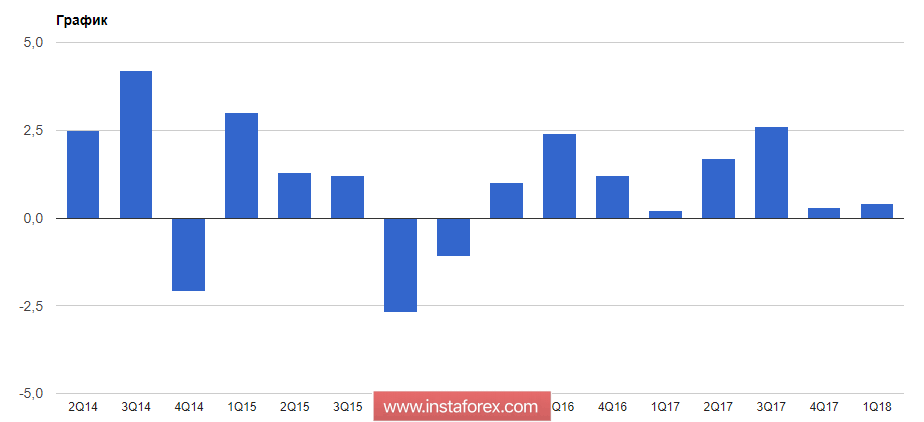

According to the report of the US Department of Labor, labor productivity in the first quarter of 2018, although it showed growth, but at a slower pace.

Thus, labor productivity outside the country's agriculture grew by only 0.4%, whereas earlier it was reported an increase of 0.7%. In the fourth quarter of 2017, productivity growth was 0.3%.

Specific labor costs in the 1st quarter increased by 2.9% per annum.

Economists expected an increase in labor productivity outside agriculture by 0.6%, and unit labor costs were to grow by 2.8%.

The deficit of foreign trade in the US in April fell, due to the fact that Americans bought less foreign goods. Good growth was noted in exports, primarily due to record volumes of oil.

According to the US Department of Commerce, the foreign trade deficit in April this year fell by 2.1% compared to the previous month and amounted to 46.20 billion dollars. Import fell by 0.2%, while exports increased by 0.3%. Economists had expected a deficit of $ 48.7 billion.

As for the duties imposed by US President Donald Trump, it is unclear from the report whether they brought their own benefit or not.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română