The euro is in demand this week. Paired with the dollar, the single currency is already entrenched in the 17th figure and still demonstrates the upward movement. The growth of the EUR/USD pair is mainly due to the demand for the euro, and not the weakness of the US currency. However, greenback also suspended the rally, despite the success of the US economy.

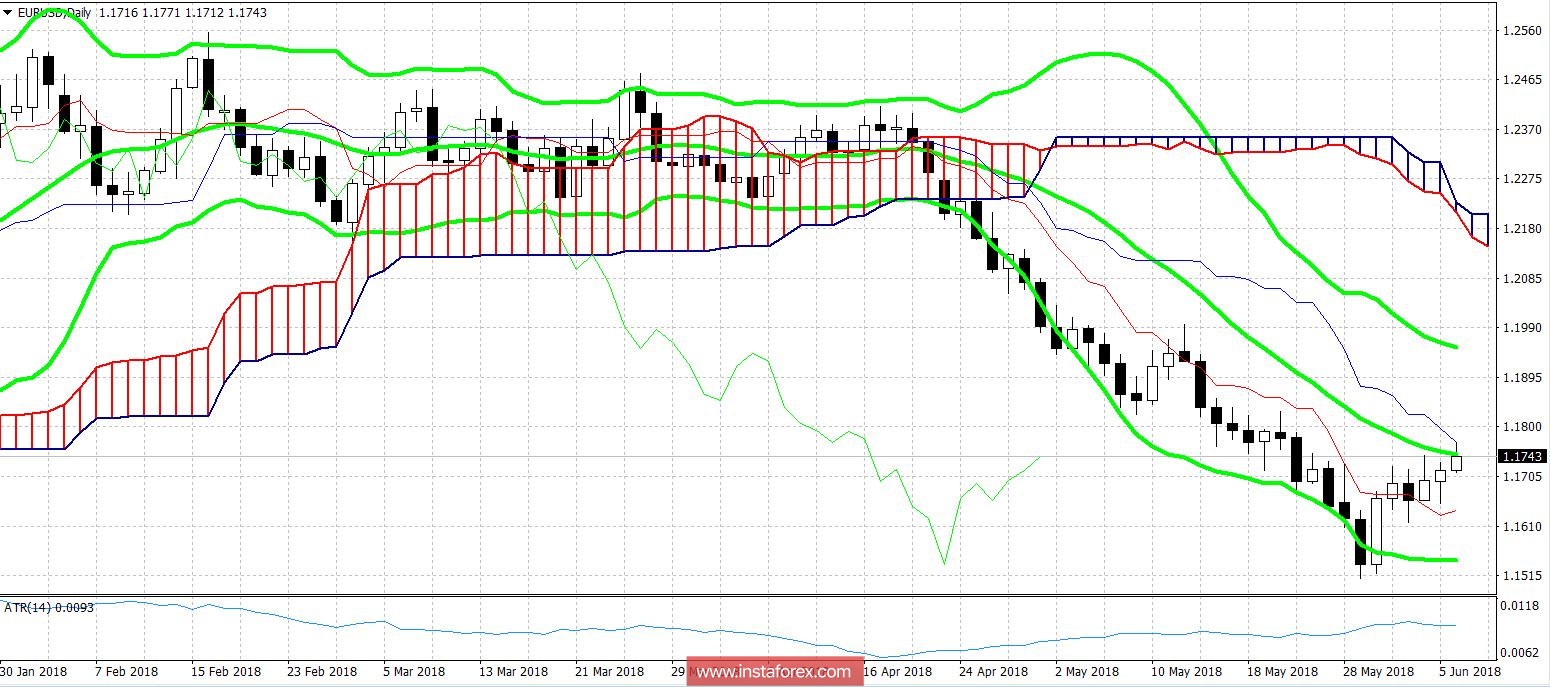

But let's start with European information guides. The common currency received unexpected support from all sides: the political situation in Italy and Spain stabilized, inflation resumed growth, and the rhetoric of the ECB members became noticeably tougher. Such a combination of fundamental factors against the backdrop of an almost empty economic calendar helped the EUR/USD bulls to escape from annual lows, and now the price is trying to overcome a not very strong resistance level 1.1770 (the Tenkan-sen line on the daily chart).

In general, traders had reasonable hopes for the renewal of the ECB's "hawkish" intentions regarding QE and even the interest rate. Literally yesterday, the Italian Parliament put an end to the multi-week political crisis, having approved the composition of the government. Despite the fact that populists and Eurosceptics were de facto in power, Rome is now far from implementing anti-European scenarios (such as withdrawing from the EU or the euro area). In addition, the post of Minister of Economy was occupied not by the odious "enemy of Brussels" Paolo Savonne, but by the pro-European professor Giovanni Tria. In other words, the Italian events are no longer on the agenda of traders, as well as the events in Spain, where the Prime Minister and, accordingly, the government changed. The market turned this chapter over, although several weeks in a row the euro was under the yoke of political uncertainty.

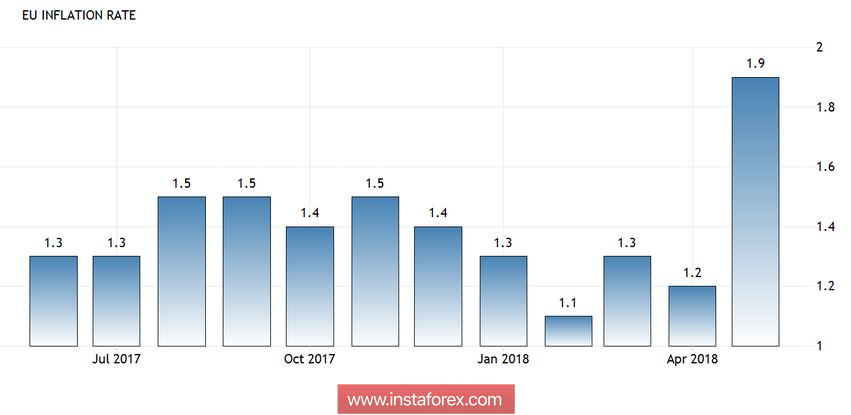

It should be noted that the hype of political battles eclipsed a very important event. European inflation resumed its growth, falling to 1.9%. This indicator has reached its peak since April last year after a significant decline. The core consumer price index (without taking into account volatile prices for energy, food and spirits) also turned out to be better than expected, having reached the level of 1.1%. The powerhouses of the European inflationary growth were Germany and France. In these countries, inflation overcame the ECB's target, having jumped 2.3% in May.

Such confident dynamics suggests that at the June meeting of the European Central Bank (which will be held the following week), the regulator members will discuss the issue of curtailing the stimulus program and, possibly, designate a temporary landmark (autumn of this year). Representatives of the ECB indirectly or even directly confirm this assumption. For example, the chief economist of the Central Bank Peter Praet said yesterday that this issue will be included in the agenda of the June meeting. In general, Praet surprised traders with his optimistic statement. He focused on the growth of the European economy, as well as on existing signals indicating that inflation is reaching the target level of the ECB.

In other words, he hinted quite transparently on the completion of QE at the end of the third quarter of this year. And although he repeated the position of Mario Draghi that the rate will remain at the same level and after the exit of the stimulating program, the market was optimistic about such words. The fact is that next year the composition of the ECB will change significantly - first of all, the cautious "dove", Draghi will leave his post. The head of the ECB is likely to be occupied by the German Jens Weidmann, who consistently takes a "hawkish" stance on the prospects for monetary policy. Therefore, the market for the most part expects a rate hike in the second half of 2019, and the completion of QE in this context is seen as an "intermediate stage". By the way, today the head of the Estonian Central Bank Ardo Hansson, who is also a member of the ECB, spoke. He supplemented the original list of "hawks", stating that the interest rate can be increased "before mid-2019".

Thus, the market demonstrates the demand for European currency, and this demand is very justified. But, despite the positive fundamental picture, traders are cautious about the growth of the euro/dollar pair. First, the demand for the euro is fueled only by rumors of the soon-winding QE, while the ECB's meeting ahead and therefore-the risk that these rumors pose will not find their confirmation. Secondly, the US economy continues to gain momentum (the latest example is the sharp increase in the ISM index of the non-manufacturing sphere in the US), so the dollar's position can not be written off. Now the greenback has suspended its growth because of the renewed uncertainty surrounding US-China relations. If the conflict worsens, the dollar will again be under strong pressure, but an alternative scenario can not be ruled out either.

That is why the growth of EUR/USD is so cautious. On the one hand, traders see the euro in certain perspectives, on the other hand, the June meeting of the ECB can present an unpleasant surprise.

Technically, if the EUR/USD pair overcomes resistance level 1.1770, the path will be opened to the next resistance level - 1.1950 (the average line of the Bollinger Bands indicator on the daily chart). This targeting of the pair's bulls can reach and before the ECB meeting, following the principle of "buy on the rumor". If the European regulator confirms the "hawkish" intentions, the EUR/USD pair will again return to the area of 20 figures.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română