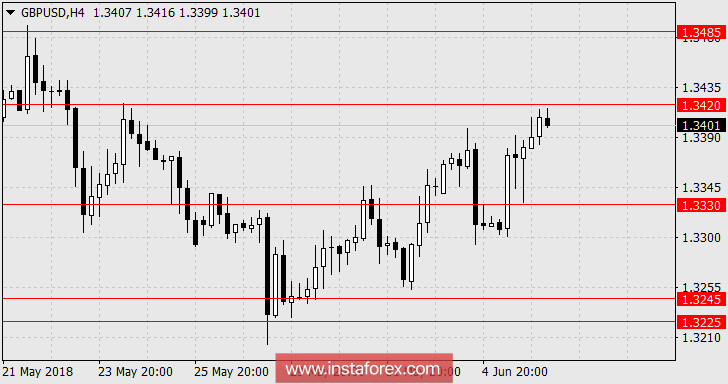

GBP / USD

On Tuesday, the British pound grew by 80 points thanks to the sharp growth of the Services PMI. In May, the index was 54.0 versus April's 52.8 and the forecasted 52.9. But the American ISM Non-Manufacturing PMI showed no less impressive growth from 56.8 to 58.6. Stock index S & P500 added 0.07%, and Dow Jones further decreased by 0.06%, which led to the weakening of dollar pressure and the pound was able to take advantage of it.

The dollar base remains reliable and strengthened. Market expectations of the rate hike at the Fed meeting on June 13 rose from 92.5% to 97.5%, while government bond yields for today show slight growth, remaining to be in the range generally since Monday. According to the UK, there will be no important data until the end of the week, while the US trade balance for April will be released today, the forecast for which is -50.0 billion dollars against -49.0 billion in March. Tomorrow, the volume of consumer loans for April will be published, with a forecast of 13.9 billion dollars against 11.6 billion in March.

We are waiting for the pound to return to 1.3330 and further decrease in the range of 1.3225 / 45.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română