Rumors about the expansion of oil production by Saudi Arabia and Russia led to the development of correction of the North Sea grade to a monthly minimum. Bloomberg, referring to competent sources, circulated information that Washington asked OPEC to increase its production of black gold by at least 1 million b / s, as retail gasoline prices in the US rose to a maximum of three years. Earlier, Donald Trump accused the cartel of artificially inflating the value of Brent and WTI, and in June, the States moved from the accusations to requests.

Since early 2017, OPEC and 10 other oil-producing countries, including Russia, have cut production by 1.8 million b / s, which has helped to balance the market and led to a reduction in global stocks and a price increase to the maximum since autumn 2014. Currently, the cartel pumping 31.9 million b / s, which is the minimum indicator for the year. If Saudi Arabia and Russia decide to increase production at the summit in Vienna on June 22-23, other countries can follow their example with the goal of preserving their market share. In addition, if Washington's request to Riyadh did indeed take place, this will exacerbate the already strained relations of the Saudis with Iran.

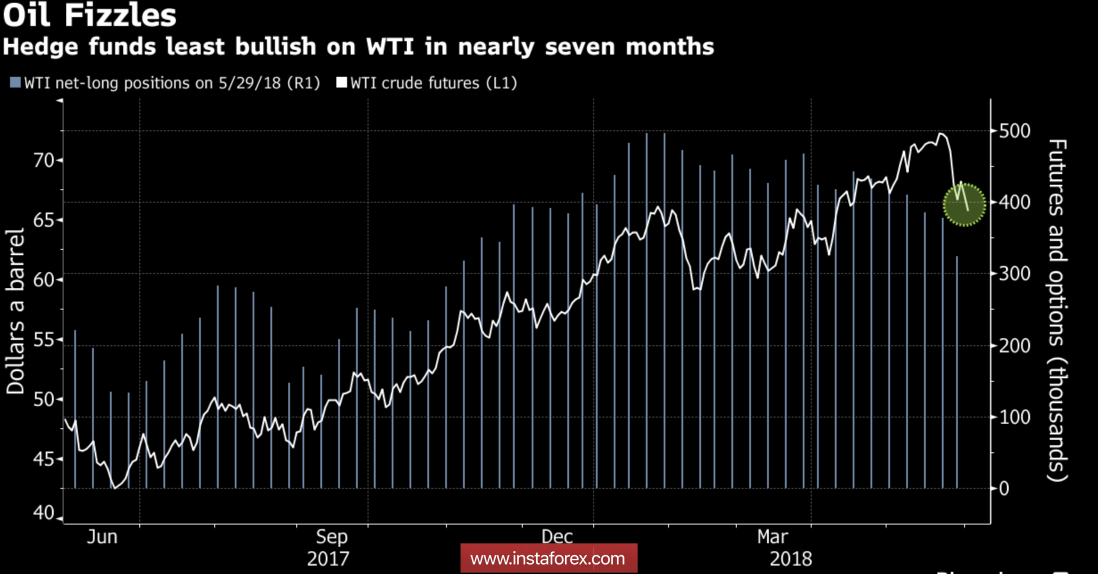

Theoretically, the risks that producers around the world will flood the market with cheap oil are a strong argument in favor of the development of correction of Brent and WTI. In fact, there is a process of closing record-breaking net-longs for the main grades of black gold due to the implementation of the principle "buy on the rumor, sell on facts". Talks about the US withdrawal from the nuclear agreement with Iran tossed futures quotes to the 3.5-year highs, and as soon as this event happened, hedge funds began to gradually record profits on long positions. They do this already for 6 consecutive weeks, which is the longest period for this development cycle of the commodity market. By the end of the five-day period by May 29, net lows for Brent fell 9.9% to 451,996 contracts, the lowest level since September 2017.

Dynamics of speculative positions and oil prices

It is curious that the spread between the North Sea and Texas oil reached $ 11 per barrel, the highest since 2015 amid US production growth to 10.47 million b / s, an increase in the number of drilling rigs to 861 and the limited capacity of American pipelines.

In general, despite the correction, the conjuncture of the black gold market remains bullish. Global demand is strong, world stocks are returning to the levels of 5-year averages, and Saudi Arabia and Russia's intention to increase production is associated with its reduction by Venezuela and Iran.

Technically on the daily chart, Brent continues the implementation of the pattern "Splash and reversal with acceleration." The break in the trend line of the acceleration stage does not yet indicate a change in trend. The proximity of the target of 127.2% on the "Perfect Butterfly" pattern to the lower border of the ascending long-term trade channel indicates the limited potential of the correctional movement.

Brent, the daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română