To open long positions for GBP / USD, you need:

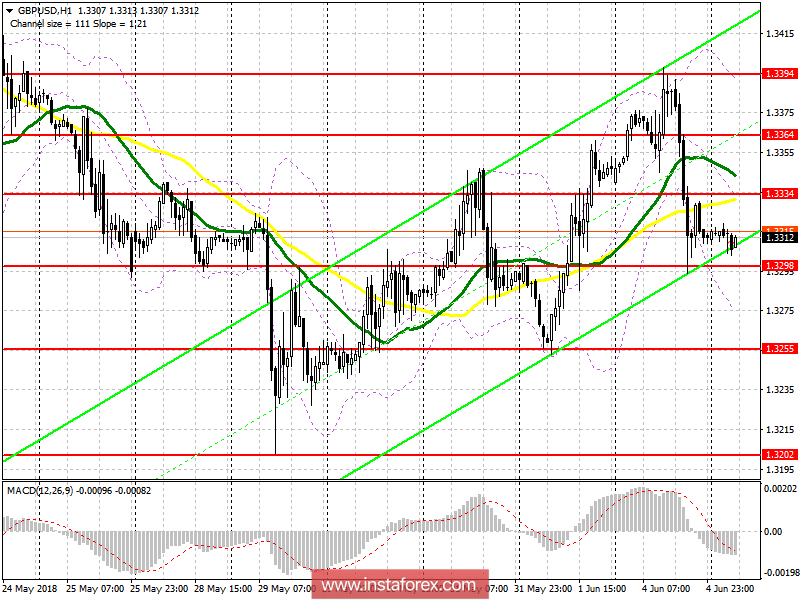

Only the formation of a false breakdown at the support level of 1.3298 and good PMI data in the service sector of the UK will allow us to return to the resistance level of 1.3334, which was missed yesterday afternoon. Above this level, the demand for the pound will increase, which will lead to the renewal of the larger resistances areas of 1.3364 and 1.3394, where it is recommended to lock in profits. In case of a breakout of 1.3298, buying the GBP / USD pair is best around the areas of 1.3255 and 1.3231.

To open short positions for GBP / USD, you need:

The bears will expect a consolidation below the level of 1.3298, which will serve as the first signal for opening short positions with an exit at 1.3255. Weaker data on the service sector may cause a major drop in the GBP / USD pair with a test of lows around 1.3231 and 1.3202, where it is recommended to lock in profits. To sell the pound on growth is possible from the area of 1.3364, and better slightly higher, from the resistance level of 1.3394.

Description of indicators

MA (moving average) 50 days - yellow

MA (moving average) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română