The Australian dollar began trading week with a sharp leap across the market: paired with the US currency, the "Aussie" jumped almost 100 points.

This price momentum is primarily due to the positive internal data. In particular, the operating profit of Australian companies increased by 5.9% in the first quarter, while the forecast was at the level of three percent. This indicator shows steady growth, although in the third quarter of last year it was in the negative area. Such rapid market reaction to a secondary macroeconomic indicator is due to the fact that it indirectly indicates the growth of inflationary expectations. The structure of the above indicator shows that in the first quarter, not only the annual profit of companies increased, but also wages - by 0.8% in quarterly terms and by 5.1% on an annualized basis. Such dynamics makes it possible to talk about probable growth of price pressure in the foreseeable future.

A somewhat weaker US dollar played a certain role in the northern breakthrough of the AUD/USD pair. As expected, the Friday hype over the strong non-farms payroll data came to naught, and the dollar bulls focused on the US-China trade negotiations. And on this "front" the situation remains complicated. On the weekend, US trade minister Wilbur Ross held talks in Beijing with Chinese Vice Premier Liu Hae. This meeting did not bring any significant results. Moreover, the Chinese official warned that the conclusion of the trade deal is under threat, taking into account Washington's intentions to resort to new tariffs. In turn, the White House yesterday issued a statement on the introduction of new tariffs on goods, which are associated with the national development program "China 2025". In addition, the US intends to impose a restriction on investment activities and to tighten the visa regime for the citizens of China.

Against this backdrop, the dollar index again shows a negative trend, having declined to 93.76 points at the moment. To some extent, the weakness of the greenback is reflected in all dollar pairs, so the positive Australian data only spurred the growth of AUD/USD.

It is worth recalling that tomorrow will be the June meeting of the Reserve Bank of Australia. The rhetoric of the RBA's accompanying statement may provide additional support for the "Aussie", although there is a certain risk. The regulator can focus its attention on problematic issues, voicing a cautious approach. For example, recent reports indicate a slight increase in unemployment (to 5.6%) and a decrease in the rate of inflationary growth (to 0.4% on a monthly basis). As for the growth of the Australian economy as a whole, but to date there are only data for the fourth quarter of last year - the indicator slowed to 0.4% after growth to 0.7% in the third quarter. But the indicator of GDP growth in the first quarter will be published only on Wednesday, that is, after the June meeting of the RBA. The average forecast is optimistic: growth to 0.8%. But this is just a forecast, so the regulator will assess the situation tomorrow only on the available factual data.

The renewed growth of the Australian dollar also has a downside. The central bank of Australia has repeatedly said that strengthening the national currency will slow the growth of the economy and, above all, inflation. At the moment, the AUD/USD pair has returned to the April highs, so the regulator can express concern about this fact.

Chinese relations with the US can also affect the mood of the regulator's members. This week, China will release data on the trade balance. According to the general forecast, China's trade surplus will grow to $32.5 billion after a modest April figure of $28.8 billion. Chinese exports is expected to grow to 6.3%, but imports – by 16%. This release will be very interesting, in the context of the influence of the US-China trade conflict. China is Australia's main trading partner, therefore, Chinese macroeconomic indicators are of significant importance for the country's economy.

Thus, the most important releases for the RBA will be published after the June meeting, and already published reports show a slowdown in key indicators. This indicates that the regulator is likely to take a cautious and wait-and-see attitude with a high degree of probability. In general, the market does not expect any action from the RBA (according to some analysts, the interest rate may be raised not earlier than in the autumn of 2019), but the pessimistic mood of the regulator's members may slow the northern movement of the AUD/USD.

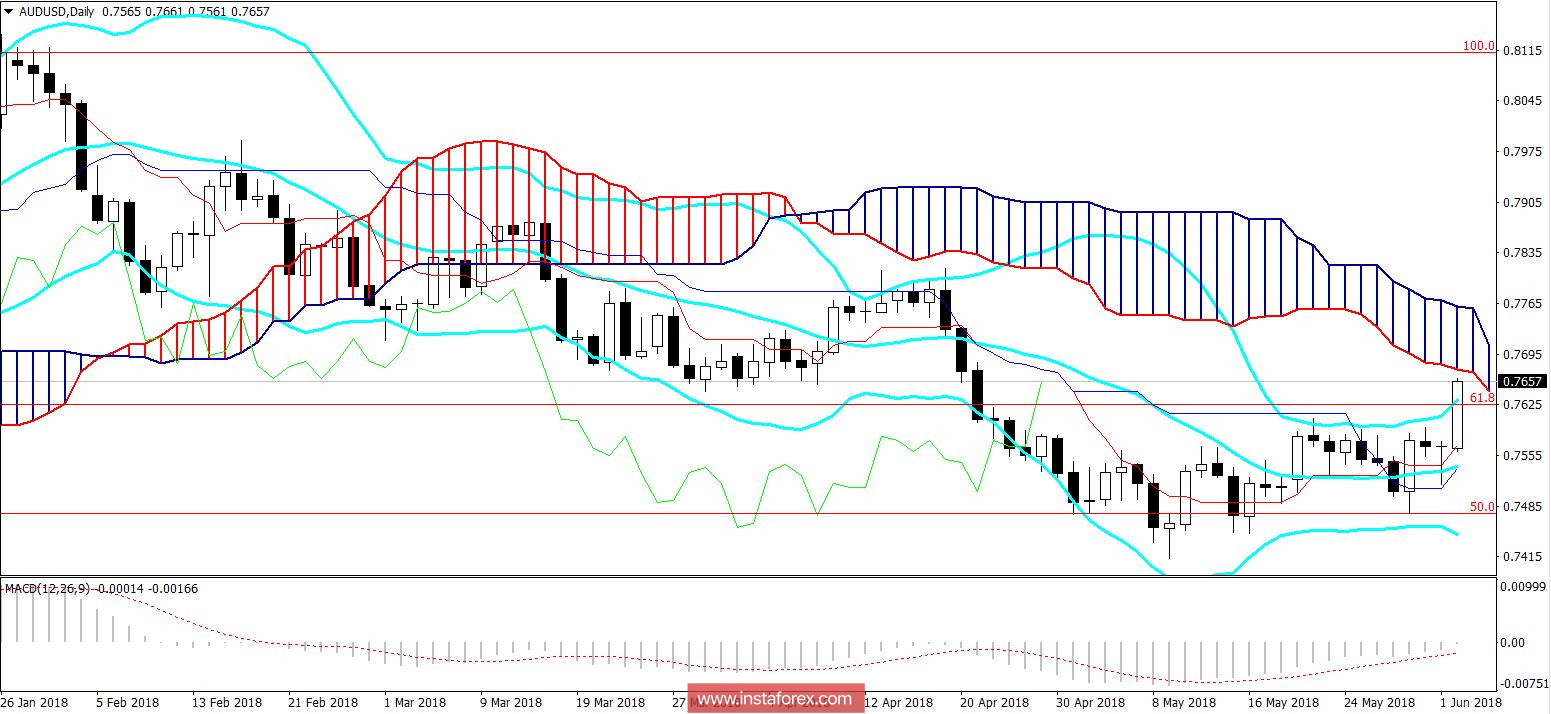

From the technical point of view, the situation is also uncertain. On the daily chart, the price went to the Kumo cloud, being on the top line of the Bollinger Bands indicator and on the Tenkan-sen line. About the development of the northern trend can only be said when the pair secures above the upper boundary of the cloud Kumo, that is, above the 0.7760 mark. In this case, the indicator Ichimoku Kinko Hyo will generate a bullish "Line Parade" signal, opening the way to the 80th figure. But before overcoming the 0.7760 level, the current momentum looks unreliable, so at the moment we can consider short positions from the current levels, with the first price target 0.7555 (Tenkan-sen line on D1).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română