The US dollar is again beginning to increase its pressure on the currency markets. And there are a number of reasons for this.

The introduction of new trade duties on imports of steel and aluminum from Europe, Canada and Mexico by the United States today, as announced on Thursday, clearly shows that President Trump "does not joke" even with his allies. If there was a hope earlier that it will be possible to somehow agree or postpone it for a rather long period, this news shows that economic, not allied interests are now in the focus of attention of the current White House Administration.

On this wave, on Thursday, after attempting to grow at the opening of the trading session, the main US stock indexes were under pressure. Investors primarily sold shares of large manufacturing and multinational corporations, as the market showed fears that a trade war could damage the profits of companies. This also caused new fears that this could stimulate an increase in inflationary pressures and would have a deterrent effect on world economic growth. Moreover, if the talks between Washington and Beijing fail, that is, there will be no compromise, then this will be another major painful point in the world economy, which will lead to a full-scale trade war between the two most powerful economies of the world with all the negative consequences that follow.

In the wake of these events, the US dollar again began to receive support in the currency markets, fulfilling its function as a safe haven. It seems that investors believe that in the trade war, the US will suffer least of all and that the dollar will be more stable than, for example, the British currency or the euro, as well as a number of other major currencies. In this situation, it is believed that the regional currencies or EM currencies may be the most affected.

In any case, strong data on consumer inflation in the euro area was published on Thursday, in which the indicator jumped 1.9% year-on-year from 1.3%, did not provide long-term support for the euro, which remains under the negative influence of political events in Italy and Spain.

Today, the focus of the market will be data on employment in the US. If the figures are not worse than expected, the dollar can get local support.

Forecast of the day:

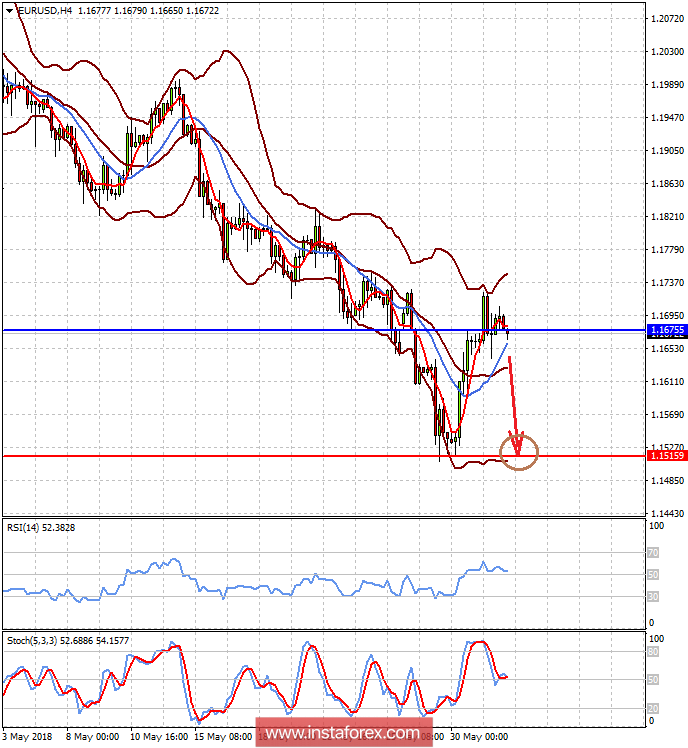

The EURUSD remains in the short-term downtrend. If employment data in the United States proves to be strong, we can expect the pair to turn down towards 1.1515.

The GBPUSD is trading below the 1.3300 level. The pair may continue to decline against the backdrop of positive news for the dollar from the US unemployment and fall again to 1.3200.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română