The Canadian dollar rose sharply against the US dollar after the Bank of Canada left the target value of the one-day interest rate unchanged, which reduced some of the tension among market participants who feared that the regulator could lower interest rates or hint at a milder monetary policy in the case necessity.

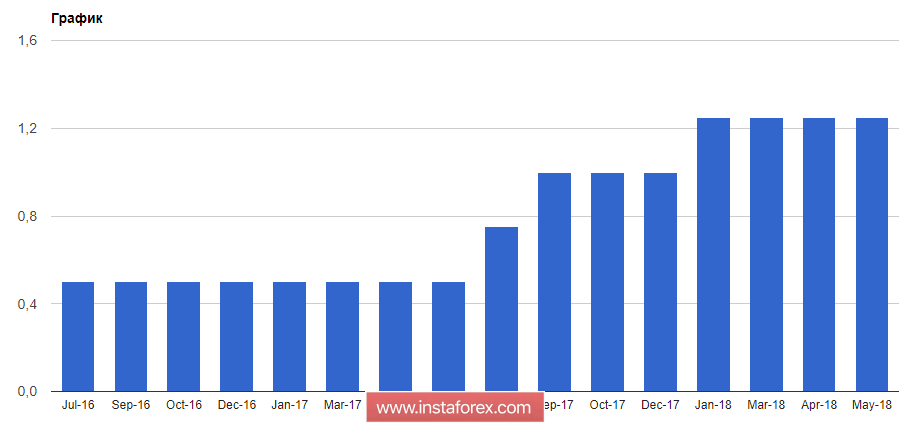

According to the data, the interest rate remained unchanged at 1.25%, while the economists of the Bank of Canada believe that economic activity in Canada in the first quarter of this year was slightly stronger than forecasted initially. The data also indicate that the outlook for the economy has improved somewhat, but there is still uncertainty regarding trade policies that negatively affect world investment.

All these statements allowed traders to build long positions in the Canadian dollar, but already today, by the afternoon, some of them were fixed, which led to the formation of an upward correction in the currency pair USD / CAD.

The data on the growth of the current account deficit in Canada's balance of payments in the first quarter of this year had a negative impact on the Canadian dollar. The growth of the deficit occurred against the backdrop of growth in the deficit of trade in goods, as well as an increase in the deficit of profit from investment.

According to the report of the Canadian Statistics Agency, Canada's current account deficit in the first quarter of 2108 was 19.50 billion Canadian dollars, compared to 16.49 billion Canadian dollars in the previous quarter. Economists had expected the deficit to be 18.20 billion Canadian dollars.

The good data on inflation leveled a weak report on the deficit. The rise in inflation allows the Bank of Canada not to rush to change interest rates.

According to the data, producer prices for Canada in April this year rose. As in a number of other countries, growth was due to a serious increase in energy prices. The Canadian Commodity Price Index also rose. So, the index of prices in the industry of Canada in April 2018 showed an increase of 0.5% after an increase of 0.9% in the previous month. Economists were expecting an increase of 0.6%.

As for the technical picture of the USD / CAD currency pair, the trade will continue in the near future in the side channel. The upper limit is the level of 1.2990, which has been tried several times by buyers, while the lower limit is located in the support area of 1.2250-75. Going beyond, it will allow sellers to count on testing larger levels of 1.2665 and 1.2560.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română