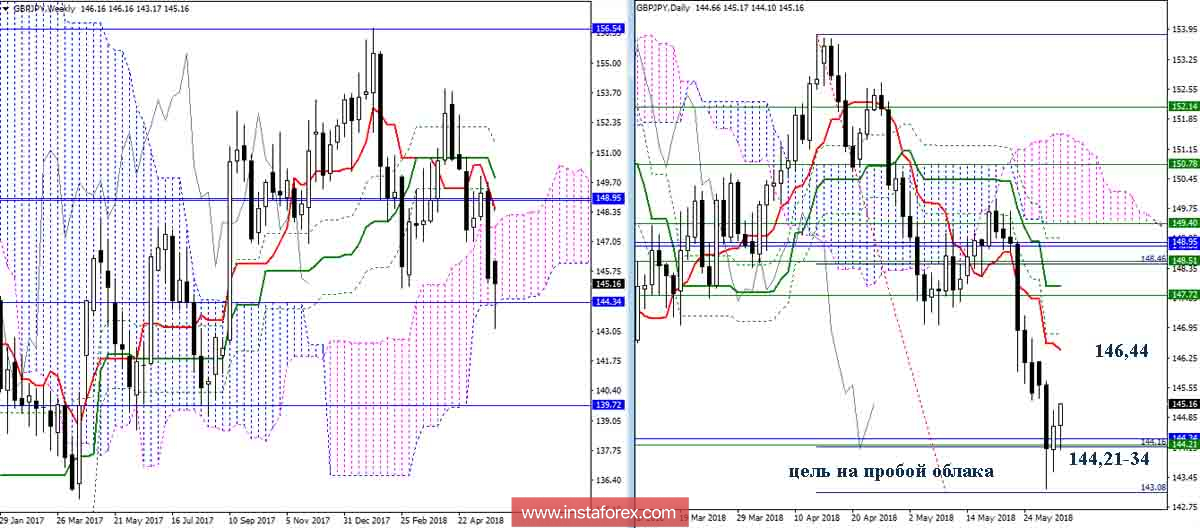

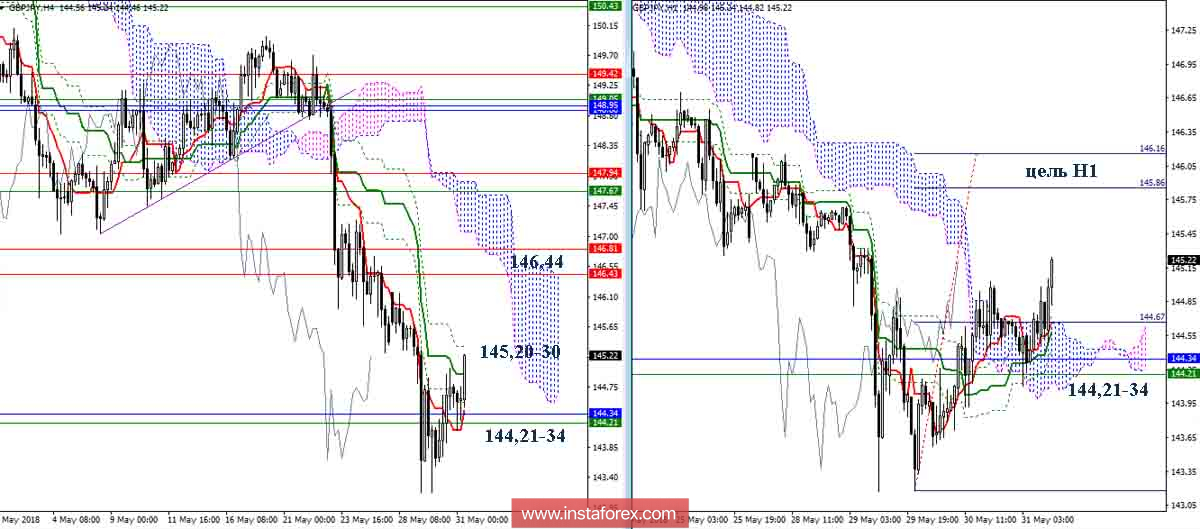

GBP / JPY

Yesterday, the players to increase, after a long decline, managed to change the mood of a daylight. If the trend continues, the bulls will be able to form a retreat from the spent day target to break the cloud and the lower boundary of the weekly cloud (Senkou Span B 144.21), strengthened by the monthly Tenkan (144.34). The immediate guide for the development of an ascending correction is the daytime Tenkan (146.44). Now, the younger time intervals seek to completely rebuild the indicator of Ichimoku to support the players to raise. As a result, after the elimination of the dead cross H4 (145,20-30), the main reference points for the ascent will be the H4 cloud and the upward target for the breakdown of the H1 cloud, the execution of which will lead the pair to the resistance area of the daily Tenkan.

Indicator parameters:

All time intervals 9 - 26 - 52

The color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray,

Clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

The color of additional lines:

Support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

Horizontal levels (not Ichimoku) - brown,

Trend lines - purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română