In the morning, data on housing prices in the UK already showed that the rate of price growth slowed from 2.6% to 2.4%, although they expected acceleration to 3.0%. However, the pound has the potential for growth, as it is expected to increase consumer lending by 1.3 billion pounds from 0.3 billion pounds a month earlier. Also, the number of approved applications for mortgages may reach 63,000 against 62,914. All this characterizes the growth of consumer activity, which will have a beneficial effect on the pound. Nevertheless, the dollar will be able to resume its growth by the evening, as the data on personal incomes and expenses should show an increase of 0.3% and 0.4% respectively. Spending grew at best for quite a long time on the same rate as income, and sometimes more slowly. This frightened investors by the fact that consumer activity may decline after inflation. So the outstripping growth of expenses will somewhat reduce the fears of investors. In turn, the expected increase in the number of applications for unemployment benefits by 2,000, which is too small to have a serious impact on the market. Moreover, on the eve of tomorrow's publication of the report on the applications data of the Ministry of Labor, very few people will be interested.

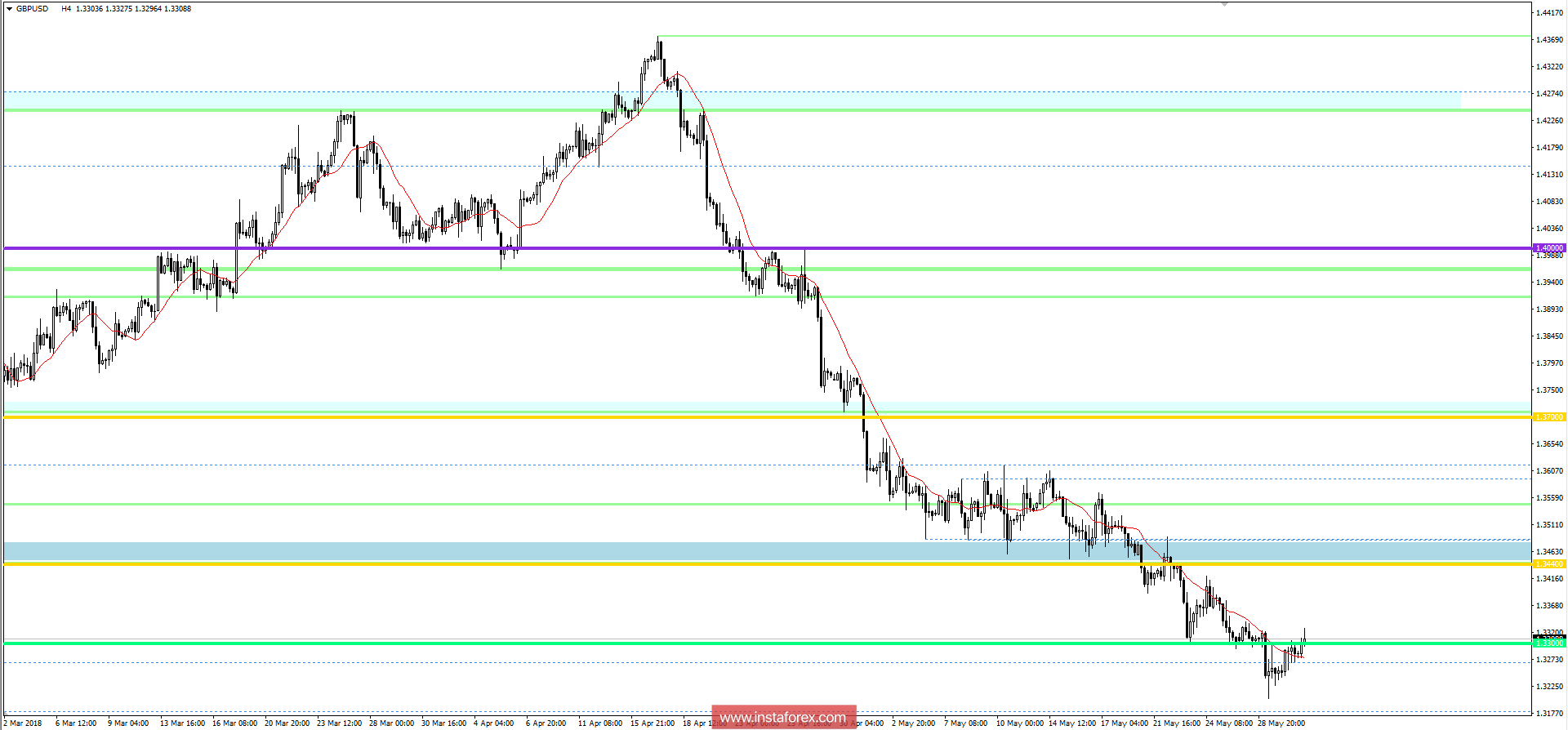

The GBP/USD currency pair felt a periodic support near the value of 1.3200, which resulted in a rollback to the previous level of 1.3300. We can assume a temporary bump within the level of 1.3270/1.3330 with further analysis of fixations.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română