The single European currency can further improve its positions for today due to quite significant macroeconomic data. Therefore, the unemployment rate should decrease from 8.5% to 8.4%, which is already quite good. But more importantly, a preliminary estimate may show an increase in inflation from 1.2% to 1.6%. Such a significant increase in inflation will clearly inspire market participants and hope that the ECB will abandon the idea of extending the quantitative easing program. The dollar has nothing to cover so serious data. The growth of personal incomes and expenses by 0.3% and 0.4% respectively, of course, the case is good but not as significant as the level of unemployment and inflation. The number of applications for unemployment benefits will remain virtually unchanged, an increase of only 2,000.

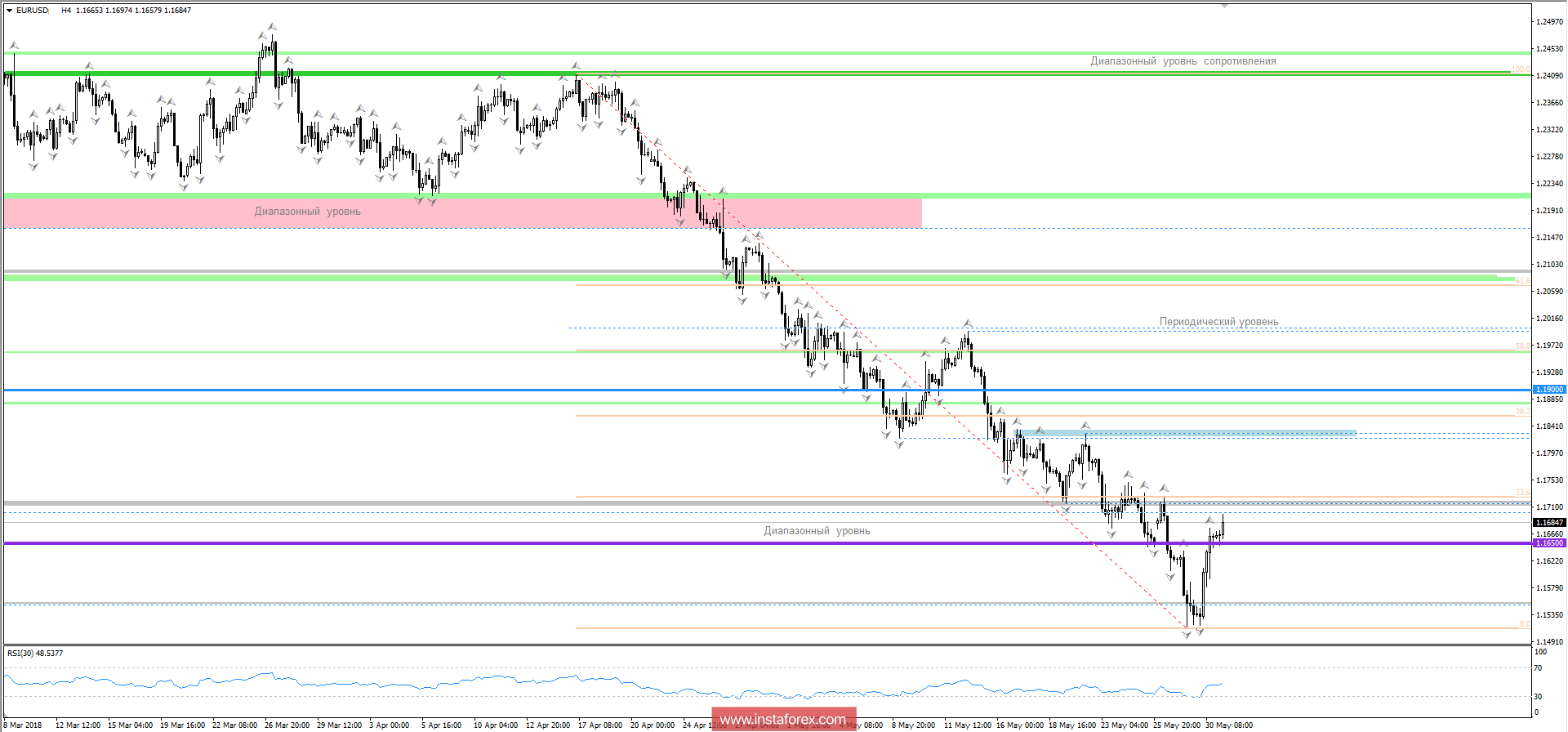

The EUR / USD currency pair has finally moved into the long-awaited correction, feeling the support near the level of 1.1500. It is possible to assume that the first coordinate, which can serve as a stop at1.1720, reflecting the periodic level in the cluster with the Fibo value of 23.6. In the case of fixation above 1.1730, we will open higher coordinates at 1.1800 / 1.1830. Otherwise, there will be a wobble at 1.1650 / 1.1720.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română