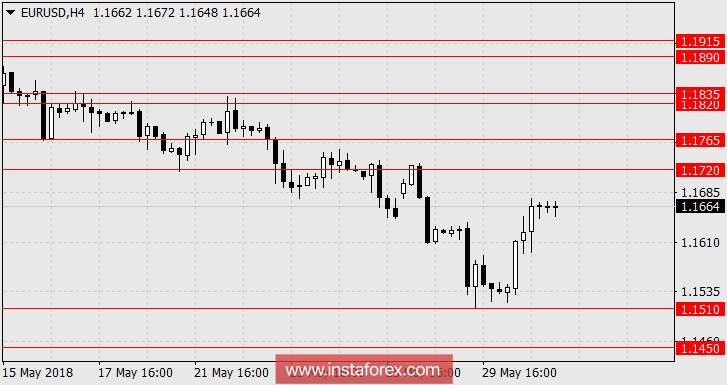

EUR / USD

The struggle for the formation of an interim government continues in Italy (the "5 star" party convinces Paolo Savona, who was nominated by the president for the post of Minister of Finance, to give up the job for the formation of the government), while investors managed to work out unfavorable for the dollar macroeconomic indicators that was released on Wednesday. German retail sales in April increased by 2.3% against expectations of 0.5%. The number of unemployed in Germany decreased by 11 thousand against the forecast of -10 thousand, and the unemployment rate fell from 5.3% to 5.2% with the expectation of the figure unchanged. The production mood of the euro area for May was 6.8 against expectations of 6.7. France's GDP in the first quarter came in at 0.2% against the forecast of 0.3%, but GDP increased from 2.1% to 2.2% in an annualized basis.In the United States, the figures came out worse than expected. The second evaluation of US GDP for the 1st quarter was revised downwards to 2.2%, instead of the potential upward revision, versus expectations of 2.3%. In the private sector, 178,000 jobs were created in May against expectations of 191,000. Wholesale inventories in commercial warehouses showed zero growth in April against expectations of 0.4%. The positive side came from foreign trade, as the April balance came at -68.2 billion dollars against the forecast of -71.2 billion. As a result, the single European currency added 125 points.

But the report of regional federal banks ("Beige Book") showed that the economic growth is quite stable ("accelerates and slows down"), the growth of wages is stable in connection with the goal of employers to attract qualified personnel. It is believe that this performance will continue for some time. Currently. the growth period of those economic sectors have a long production cycle and have not yet managed to show the effect of the tax reform.

Today, the CPI for the month of May will come out in the euro area. The base indicator is expected to increase from 0.7% YoY to 1.0% YoY, while the total CPI is expected to increase from 1.2% YoY to 1.6% YoY. Also, the unemployment rate in the euro area can show a decline from 8.5% to 8.4%. The United States also predicts good performance. Personal incomes of consumers in April are expected to increase by 0.3%, and personal expenses by 0.4%. Unfinished sales in the secondary real estate market in April are expected to increase by 0.4%. The business activity index in the manufacturing sector of the Chicago region for May is projected to grow from 57.6 to 58.2. The number of applications for unemployment benefits is expected at 228 thousand against 234 thousand a week earlier. Also, investors are already waiting for tomorrow's data on new jobs outside the agricultural sector, with a forecast of 189 thousand against 164 thousand in April. The stock market is the indicator of optimism here, as the S & P500 index added 1.27% yesterday. We are expecting for the euro to return to 1.1510 and further decline to 1.1450.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română