EUR / USD

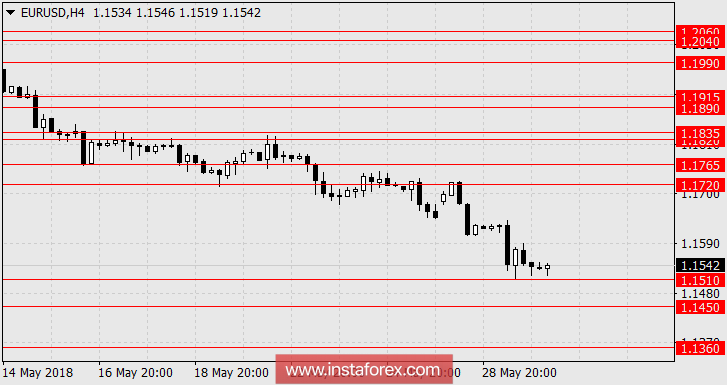

On Tuesday, the single European currency continued its rapid decline even before the opening of the American session. The new prime minister, appointed by the Italian president, Carlo Cottarelli, said that he could give up this appointment which automatically fails the adoption of the budget. And brings the new re-elections as close as possible without changing the electoral legislation that was planned to be adjusted in order to minimize the risk of equality of parliamentary seats in the case of approximately equal votes. If the elections are scheduled on July, this could mean almost complete control of the parliament by eurosceptic parties, which causes investors' anxiety. The euro fell by 86 points and technically entered the 2.5-year range of February 2015 - the summer of 2017, which can be overcome quickly enough to its lower boundary of 1.0500. Earlier, we noted that the current decline in the euro since the middle of April in its technical nature corresponds to the summer of 2014, when the Greek-Cypriot crisis raged in Europe (not without the participation of Italy and Spain themselves). It is very likely that the situation is repeating, but now involves a larger European economies located in the center. For the US and the dollar, this is a very advantageous situation and we do not expect an immediate solution in terms of political crisis.

In the US, the house price index of S&P / Case-Shiller in the 20 largest cities remained at 6.8% YoY in March, with expectations for a decline to 6.5% YoY. The consumer confidence index from the Conference Board for the May was 128.0, but the indicator was sharply revised down from 128.7 to 125.6 points in April.

Today, European investors can get a small amount of optimism from the German economic data. Retail sales in Germany for April are expected to grow by 0.5-0.7% against -0.6% in March (with a retention of 1.3% YoY). The German import price index is expected to increase by 0.7%. The number of unemployed in Germany for the current month is projected to decline by 10 thousand, while the unemployment rate is likely to remain at 5.3%. Germany's CPI for May is expected to grow by 0.3% against 0.0% earlier. In France, consumer spending for April may show a contraction of 0.2%. In Spain, the CPI is projected to grow from 1.1% to 1.7% YoY as it gradually emerges on the forefront of the political theater in Europe. So far this is a positive factor, but very soon the inflation growth in problematic countries can cause anxiety in the markets. Yesterday, the 2-year government bonds of Italy soared in profitability of fourfold from 0.888% to 2.738%, and the 10-year-olds increased from 2.68% to 3.18%.

Nevertheless, the US will also released an important data today. The change in the job number in the private sector from ADP in May is projected at 191 thousand versus 204 thousand in April. The second assessment of US GDP for the first quarter is expected to remain unchanged at 2.3%. The commodity trade balance for April is expected to decrease from -68.3 billion dollars to -71.2 billion, and wholesale stocks for April can show an increase of 0.4%.

As a result, we are expecting the decline of the euro to 1.1450 and further to 1.1360.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română