Eurozone

The political crisis in Italy remains one of the main factors contributing to the bearish outlook for the euro and any attempts at growth are willingly sold by the players. The inability to form a government and the strong positions of the Eurosceptic party threaten to provoke the onset of a new political crisis that is likely to turn into a debt crisis.

Meanwhile, the ECB on Friday reiterated its intention to complete the program for the purchase of assets in 2018, plus a discussion began about the pace and timing of raising rates. This news at any other time would have been clearly bullish, but the euro did not react much, focusing on the negative that there are clear signs of economic slowdown due to political problems.

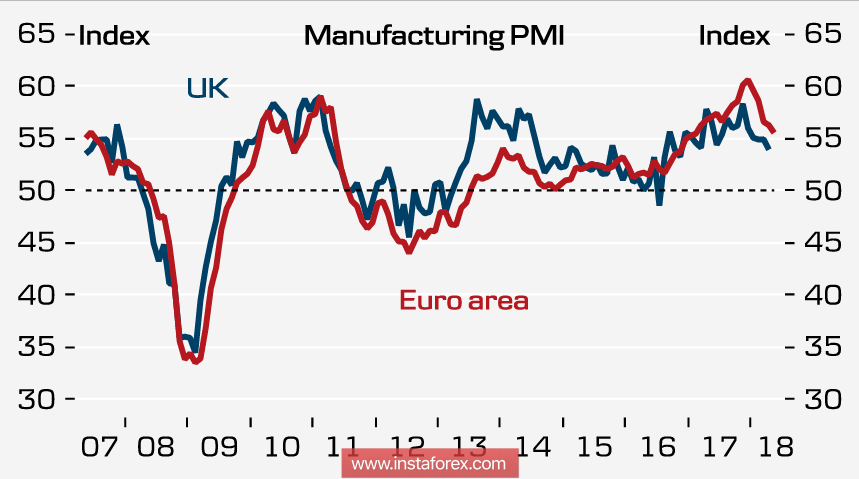

The eurozone's business climate is in a clear decline. The German ifo index in May shows the first signs of leveling after several months of strong decline while the main positive is based on an assessment of the current situation with economic expectations continuing to deteriorate.

Obviously, the economy of the largest eurozone country does not have any illusions as to how the expected growth in rates will affect it. If in the US, this process is accompanied by a sharp increase in consumer sentiment and allows for a tightening policy, since it is compensated by tax reform, then in a much more inertial eurozone such a compensation mechanism has not been developed and the rate hikes will be accompanied by rapid returns of gloomy sentiments through the efforts of the ECB.

The euro in the current environment cannot find reasons for strengthening and any growth is used for sales. This trend will continue in the coming days.

United Kingdom

The pound continues to update the lows and there are no reasons to expect its growth this week. The exit from the EU did not go according to the planned scenario and now Theresa May intends to extend the transition period until 2023 because otherwise, the impact on the UK economy will be quite substantial. As it turned out, for the soft version of Brexit, the country's manufacturing sector is not strong enough and maintaining both trade volumes with the EU and trade preferences becomes an urgent necessity.

On Wednesday, the index of consumer confidence from Gfk, which has long been stuck in the negative zone, will be published while on Thursday, the Bank of England will report on the volume of consumer and mortgage lending in April. On Friday, Markit will publish data on business activity in the manufacturing sector. Experts predict a decline to 53.6p against 53.9 months earlier.

The pound continued to fall at the opening of European session. During the day, it could fall to 1.3250.

Oil

The bullish mood in oil has declined markedly. The reason for this was the consistent statements of Russia and Saudi Arabia, which see an increased likelihood of easing the terms of the OPEC + deal. At the same time, there is a slight decrease of interest in geopolitical factors, such as Iran and Venezuela, which eventually led to a correction.

However, so far, there is no unity in the market as to what the current decline is - a correction or a full-fledged turn. The decision on possible changes in the strategy of OPEC + will be taken at the meeting on June 22 and in the nearest weeks, oil will most likely hold in the side range in anticipation of a new strong driver. Brent has strong support at 73.90 / 74.20 and is unlikely to decline yet.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română