To open long positions for EUR / USD pair, you need:

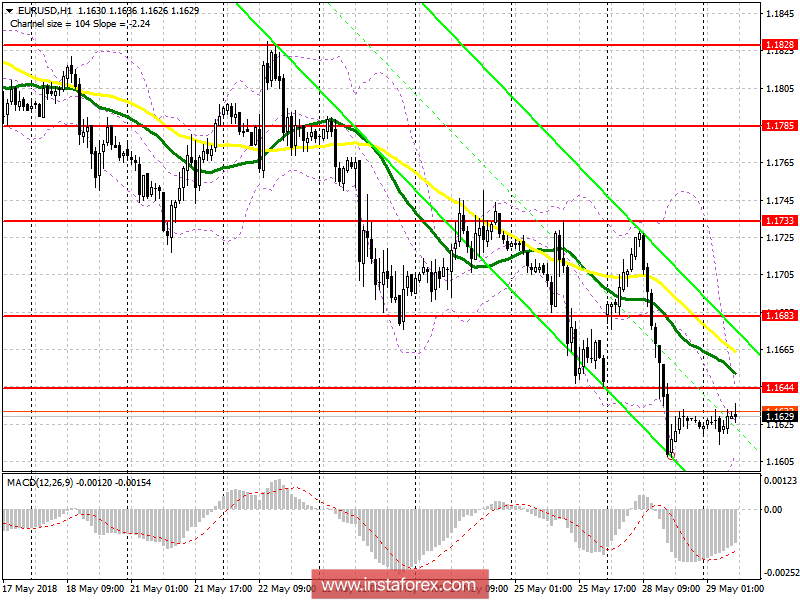

Buying a euro is possible only on a condition of a breakout and consolidation above the resistance level of 1.1644, which will allow us to count on a new wave of growth to 1.1683 and to update a larger level of 1.1733, where fixing profits are recommended. In the case of a decline of the euro in the morning, the divergence on the MACD indicator may be a good signal to buy after testing the support level of 1.1595. Otherwise, long positions can be calculated after updating 1.1565 and 1.1538.

To open short positions for EUR / USD pair, you need:

Unsuccessful consolidation above 1.1644 and returning to this level will lead to a new wave of euro sales. The purpose is to update the monthly low around 1.1595, with access to the larger levels of 1.1565 and 1.1538, where fixing profits are recommended. n case of growth above 1.1644 in the morning, sell the euro on the rebounded from 1.1683.

Description of indicators

- MA (average sliding) 50 days - yellow

- MA (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română