The dollar continued to strengthen on Monday, despite the lack of new data. Markets continue to win back the Fed's confidence in the next rate hike which is likely to happen "very soon", as the economy grows enough to tighten the policy rate.

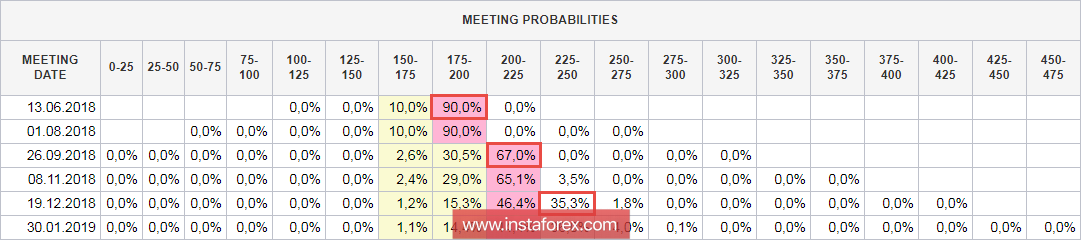

"Very soon" is already on June 13. It is on this day that the expanded meeting of the FOMC will happen and updated macroeconomic forecasts will be published. The market estimates the probability of a rate increase, according to the CME futures market, at 90% which is practically unanimous. Another increase will take place, apparently in September, at the moment the probability of this step is at 67%.

Thus by autumn, the Fed can fulfill the plan for the current year. The intrigue about another increase in December remains open. The markets do not yet see the reasons for the fourth increase but we cannot rule out such an opportunity. Obviously, the decision will be made taking into account the changed macroeconomic indicators, which at the moment, looks ambiguous.

The key indicators to which the FRS is oriented indicate a continuation of the policy of normalization. Economic growth rates are high. Markit reports confirmed once again that the preliminary PMI indices rose in May both in the manufacturing sector and in the services sector in relation to April. This means that there is an increase in business activity. Some slowdown in labor market growth was expected a year ago and is associated with the achievement of full employment at which it is impossible to maintain the previous rates of creating new jobs, and therefore, reducing Nonfarm Payrolls to 60-80 thousand per month will not be a criterion for the Fed to slow down economy and will not affect the decision on rates.

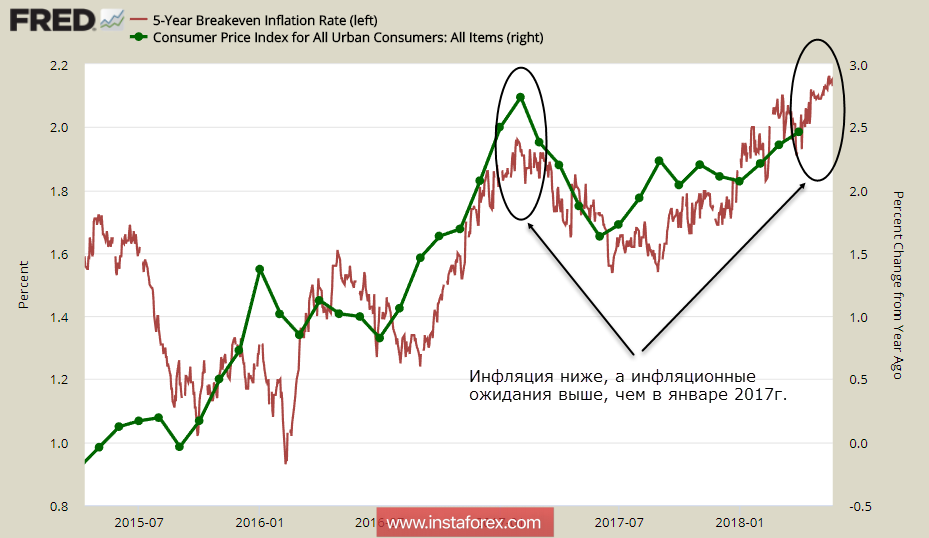

With regard to inflation expectations, the real indicators are clearly visible in the dynamics of the yields of 5-year bonds, protected against inflation. At the moment, their yield reached 2.13% as of May 22. This is significantly higher than during the previous peak in January 2017, when the yield was at 1.96%. At the same time, the official level of inflation is now lower than in January 2017. This means that there is a significant gap between expectations and real indicators, which gives the right to assume that in the coming months, the official inflation in the US will show growth and increase the chances for a fourth rate increase this year.

Thus, the formal criteria on which the FOMC is guided in the development of monetary policy indicate both further tightening and a high probability of continuing the trend towards the growth of the dollar index.

At the same time, a number of other criteria indicate that current economic growth is extremely unstable. In many respects, it is due to the tax reform, which reduced the burden on business and led to a surge in business activity. However, the downside of this process is a reduction in budget revenues due to a fall in tax collections. Simultaneously, with the growth of the economy, investors are emerging from the defensive assets, which is reflected both in the decrease in the value of gold and in the growth of yields on the bonds. The latter circumstance, along with the reduction in the balance of the Fed, makes the Trump administration nervous, since the loss of income is compensated by the rapid growth of the level of the state debt, which in the long run can not possibly be arranged.

Trump's attempt to shift some of the costs to US trading partners has not yet led to any positive result. The increase in duties on steel and aluminum has led to countermeasures by both China and the European Union. The withdrawal from the nuclear deal was not supported by US allies who intend to fight for its preservation and for the right of European companies to conduct business with Iran. No significant progress in the negotiations with China is also observed, the matter is only postponed to a later time.

The dollar will continue to strengthen against commodity currencies, which is likely to correct the oil prices down. However, against the yen and the franc, the dollar is losing ground against the flagging risk aversion. Nevertheless in the long run, there is no doubt that the dollar will continue to strengthen.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română