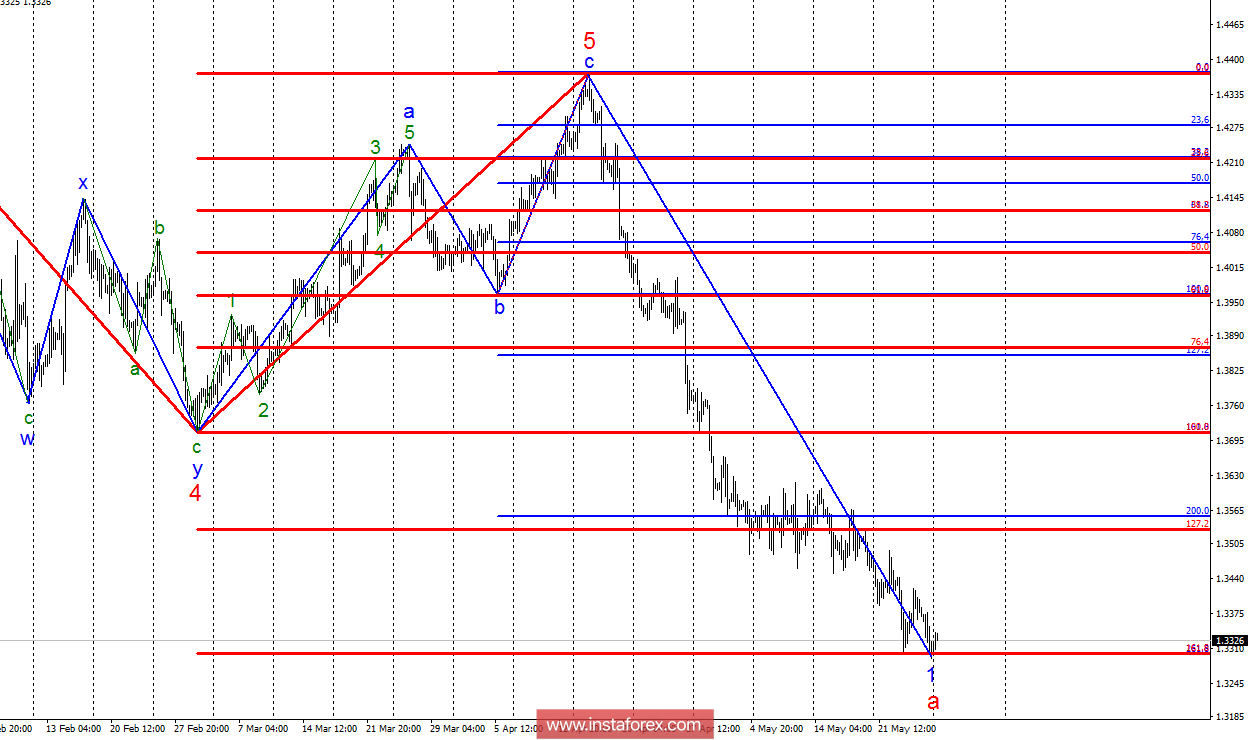

Analysis of wave counting:

In the course of trading on May 25, the GBP / USD currency pair updated the previous day's low, but the level of 33 figures again stood firm against the onslaught. Thus, the instrument continues to make attempts to the complete wave 1, in a downtrend section of the trend and transition to building a wave 2, a, with targets located about 35 and 36 figures. A break of the 1.3300 mark will lead to an even greater complication of the internal wave structure of the proposed wave 1, a, and further lowering of quotations in the region of 31 figures.

The objectives for the option with purchases:

1.3528 - 127.2% of the Fibonacci of the highest order

1.3555 - 200.0% of Fibonacci

The objectives for the option with sales:

1.3300 - 161.8% of the Fibonacci of the highest order

1.3300 - 261.8% of Fibonacci

1.3045 - 200.0% of the Fibonacci of the highest order

General conclusions and trading recommendations:

The instrument continues to attempt to complete the construction of wave 1, a. Near the 1.3300 mark, I still recommend fixing profits, and new sales should be started if a successful breakthrough of 33 figures is successful. The targets for the complicated wave 1 are located near the calculated mark of 1.3045, which corresponds to 200.0% of Fibonacci, constructed from the size of wave 5, which ended on April 17. I recommend buying the pair very carefully and with Stop Loss under the minimum of wave 1, a, as well.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română