Despite the good data on the mood in the business circles of Germany, the euro remained under pressure paired with the US dollar. However, a good morning gap up today allowed risky assets to win back some of the positions amid the political crisis in Italy where the Italian president did not allow the acting Prime Minister of Italy, Comte, to form a government. This creates a number of rather serious problems for populist parties in Italy and Eurosceptics.

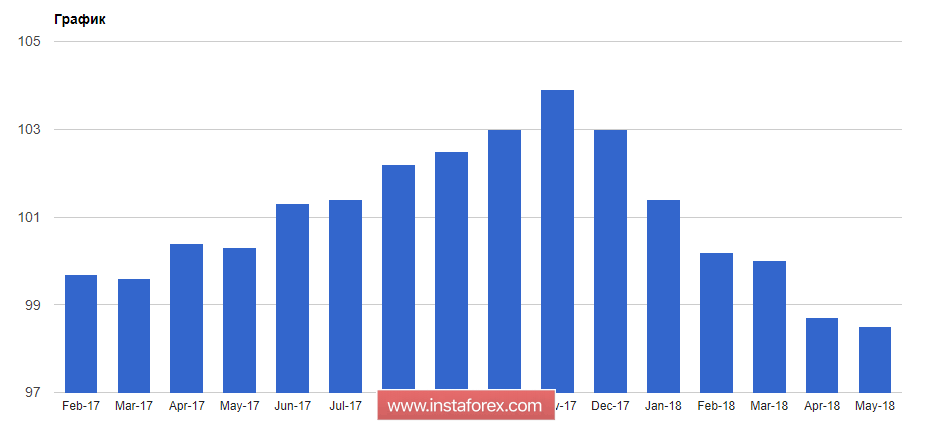

The worsening of sentiment in business circles in Germany is gradually stopping. According to the German institute Ifo, economic activity is gradually stabilizing after a serious fall earlier this year. The index of sentiment in business circles Ifo in May 2018 was at the level of 102.2 points, not showing changes compared to April. Data came out better than forecasts of economists, who expected that in Ma,y the index will be at 101.9 points.

According to the forecast of the institute, Germany's gross domestic product will grow by 0.4% in the second quarter compared with the previous quarter.

The speech of the Chairman of the Federal Reserve, Jerome Powell, in the afternoon on Friday benefited the US dollar. Despite the fact that Powell mainly spoke about the problems of the crisis and the need for transparency of actions on the part of the Fed and other central banks, many traders continued to open long positions in the US dollar, which led to the renewal of the next monthly lows in pairs with risky assets.

In the course of his speech, Powell stated that increasing transparency in the sphere of regulation will ensure the growth of confidence in the financial system. Transparency is necessary, subject to the measures taken by central banks after the crisis. According to Powell, ensuring financial stability requires a concept that is focused on preventing a crisis, and this concept should improve the stability of the financial system and improve monitoring of institutions.

The Fed chairman also talked about inflation problems, expressing the opinion that one should not forget past lessons in the lack of independence of the Central Bank caused problems with inflation.

Data on the fall in US households' confidence in the economic outlook in May this year have gone without a trace for the US dollar. According to the report of the University of Michigan, the final index of consumer sentiment in May this year was 98.0 points against the preliminary value of 98.8 points. Economists expected that in May, the indicator will remain unchanged compared to April and amount to 98.8 points.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română