GOLD

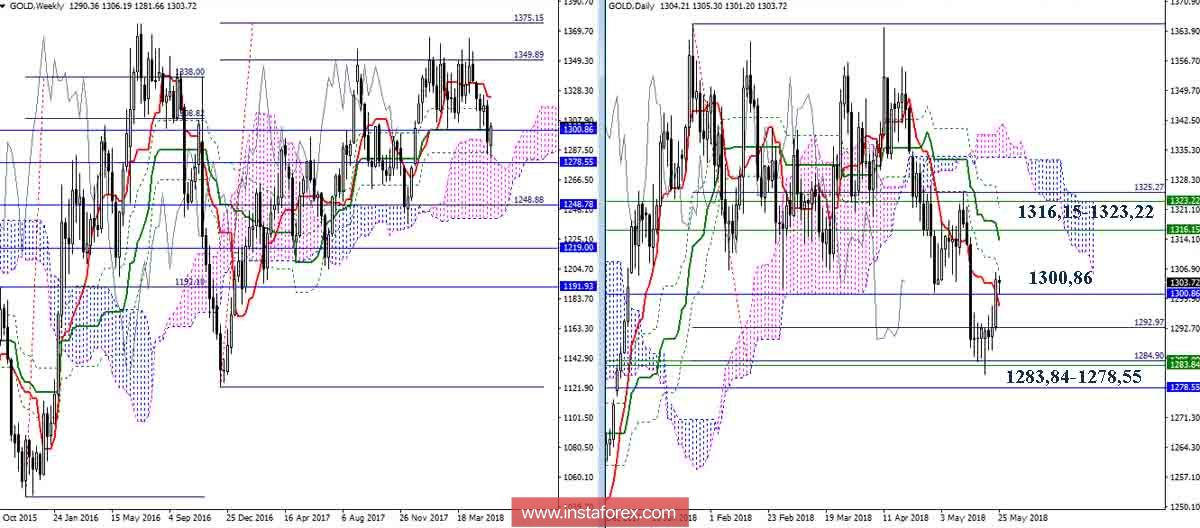

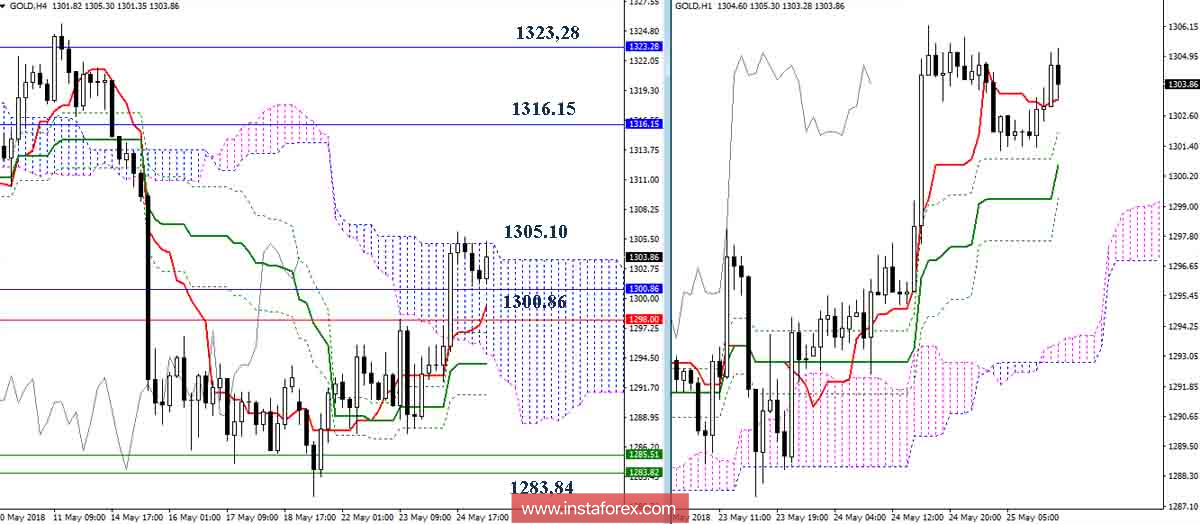

In the previous analysis of gold, it was noted that after working out the day target for the breakdown of the cloud (1284.90) and meeting with the support of several timeframes (weekly Fibo Kijun 1285.57 + Senkou Span A 1283.84 + month Fibo Kijun 1278.55), the most priority direction of development situation is a daily upward correction. Yesterday, the players on the rise were able to implement these plans and closed the day above the indicated resistance in the area of 1300.86 (monthly Tenkan + weekly Kijun + day Tenkan). The closure of the current week above the resistance levels encountered will allow us to consider a possible rise to the following targets at 1316.15 - 1323.22 (weekly Tenkan + weekly Fibo Kijun + daily Kijun + target for H4 cloud breakdown). In the event of the rebound from the levels encountered (1300.86), the support area of 1283.84 - 1278.55 still has the greatest value, its breakdown is capable of opening new prospects for players to fall.

Indicator parameters:

All time intervals 9 - 26 - 52

The color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray,

Clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

The color of additional lines:

Support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

Horizontal levels (not Ichimoku) - brown,

Trend lines - purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română