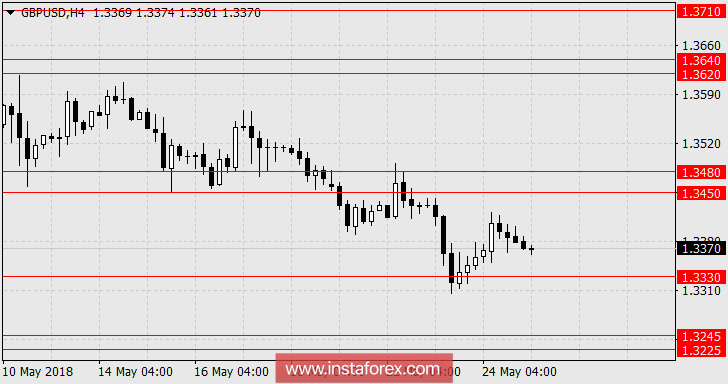

GBP / USD

The British pound grew by 32 points yesterday due to excellent retail sales figures for April which grew by 1.6% against the forecast of 0.8% and -1.1% in March (revised to increase from -1.2%). The dollar index fell by 0.29% yesterday, which was a moderate weakening and a deterrent to the growth of the pound factor. Also, investors were not in a hurry to make decisions ahead of today's GDP data. The forecast for the 1st quarter in the 2nd assessment, however, does not imply a change, 0.1% for the quarter and 1.2% on an annualized basis. Business investments for the same period are expected to decrease to 0.2% from 0.3% earlier. Also, commercial enterprise investments are expected to decline from an annual rate of 2.6% to 2.4% y / y.

In the US, mixed orders for durable goods orders for April are expected to be mixed, total volume with a decrease of 1.3%, a base increase by 0.5%.

On Monday, it is a holiday in the UK and the US, investors will try not to worsen the outcome of the week. In the coming days, we are waiting for the pound sterling in the range of 1.3225 / 45.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română