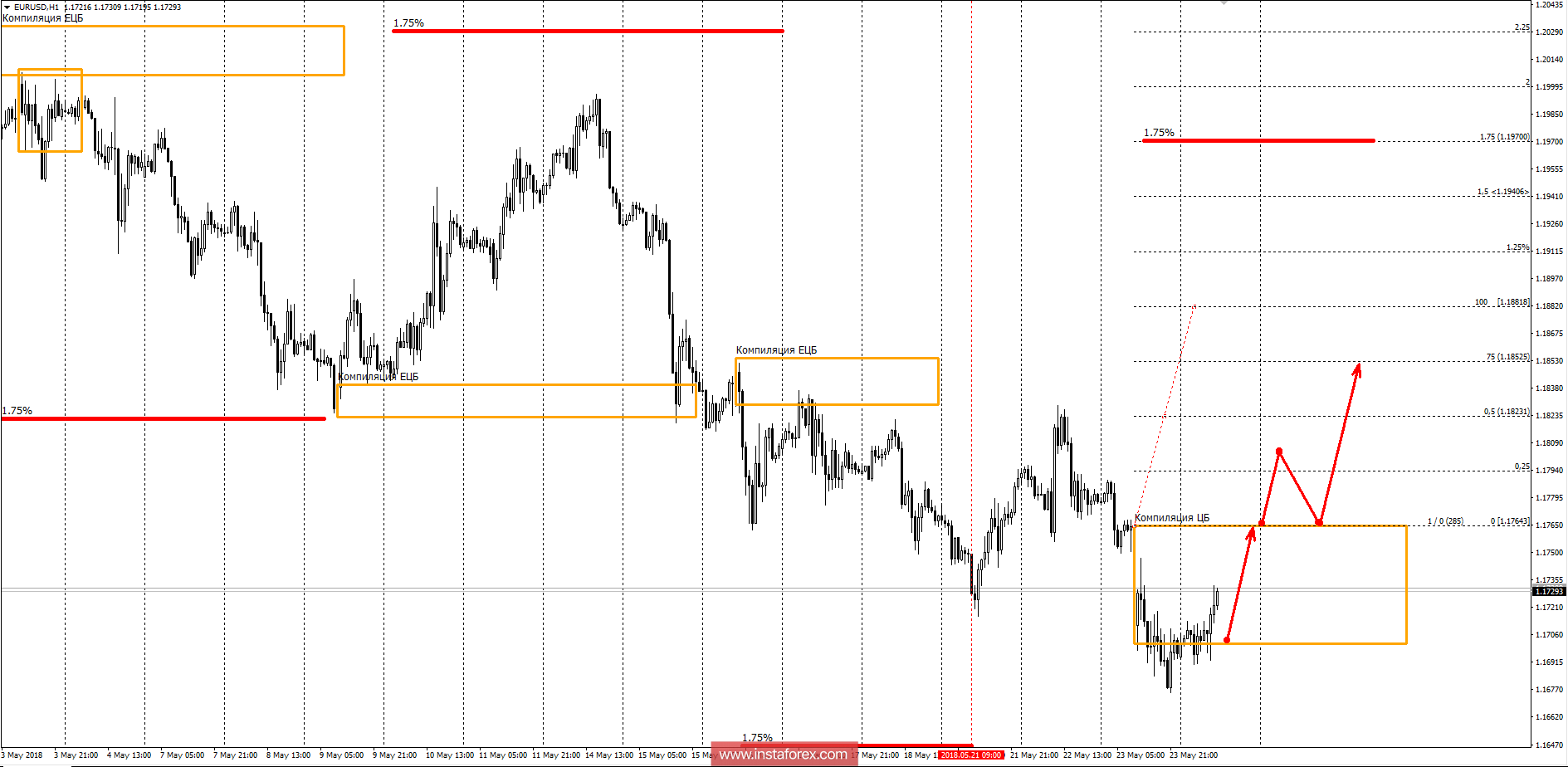

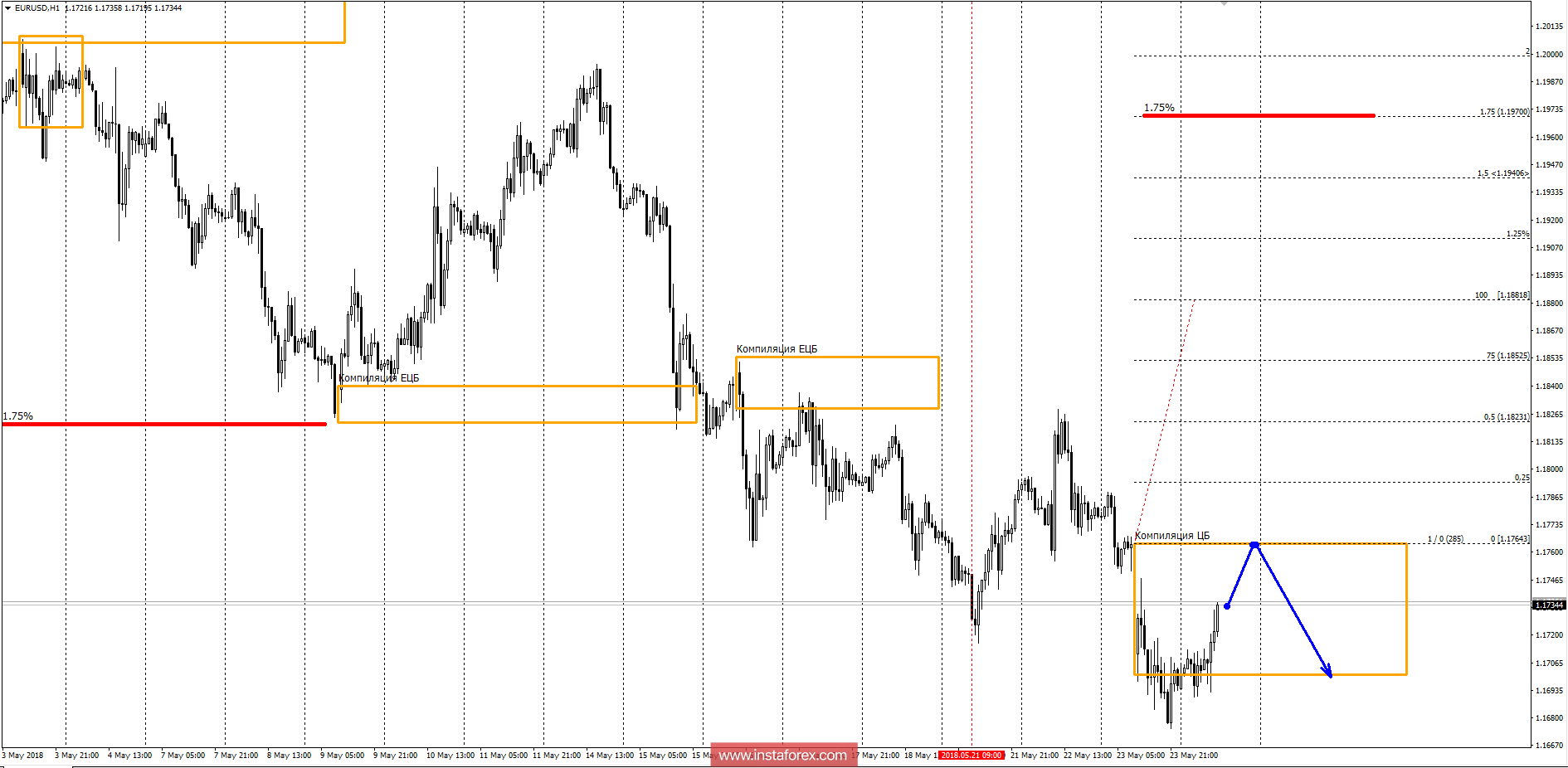

Yesterday, the open market of the European Central Bank were in regular operations which allowed us to consider further priority in terms of the bank's activity. The compilation zone of the Central Bank turned out to be quite wide, which can be the reason for the formation of the medium-term zone of accumulation and transition to the flat phase. Yesterday's attempt to consolidate below the zone of bank compilation was unsuccessful, which indicates the presence of limit orders below the range. If the pair continues to haggle in the formed zone, then the upper boundary will become both the first growth target and the main resistance. Purchases will have a limit, which will give an opportunity to fix their side and the rest to become a breakeven.

As you can see from the screenshot, fixing above the compilation zone will result in a deeper correction. Taking into account the fact that the EUR/USD pair has already overcome the average monthly drop range, the probability of this event is becoming more important. If the objective of the bank is to keep the rate above the level of 1.1700, then the absorption of the last drop and fixation above the compilation zone is expected to occur. This will allow talking about the future implementation of the medium-term correctional model, where purchases with partial fixation at significant resistance levels will come to the fore. To form an alternative model, it is necessary to keep the price within the compilation area and the occurrence of a large offer at the upper range test.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română