To open long positions for GBP/USD, it is required:

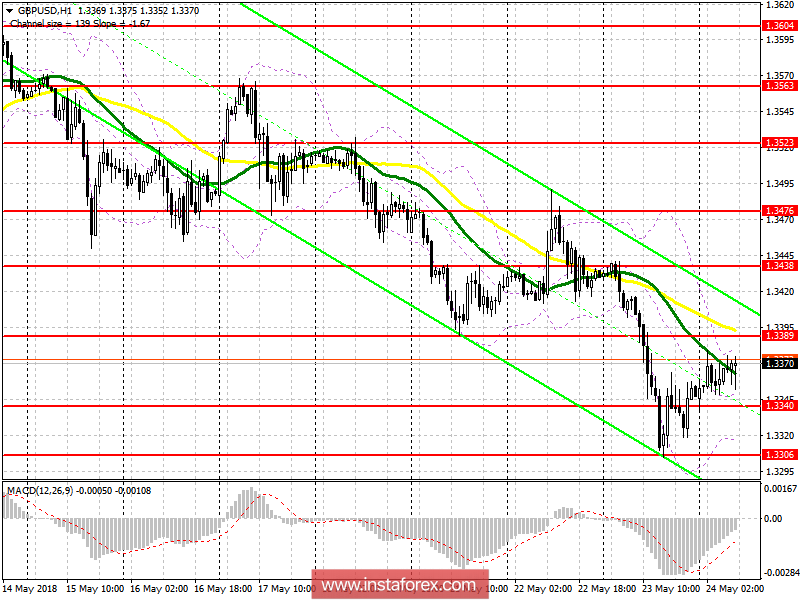

A good signal to buy the pound will be formed after a decline to the support level of 1.3340, with the formation of a false breakdown in that area, or after a steadying at the level of resistance at 1.3389, with the exit beyond the 50-day moving average, which opens the way to the area of 1.3438 and 1.3476, where I recommend profit taking. In the event of a decline below 1.3340, buying the pound can be done on the rebound from 1.3306.

To open short positions for GBP/USD, it is required:

Failure to consolidate above 1.3389 will be the first signal to sell the GBP/USD in order to reduce and break the support of 1.3340, below which the pair can quickly fall to the area of Wednesday's lows of 1.3306, where I recommend profit taking. In case of growth above 1.3389, the pound can be sold on a rebound from 1.3438.

Indicator description

- Moving Average (average sliding) 50 days - yellow

- Moving Average (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română