To open long positions for EURUSD, it is required:

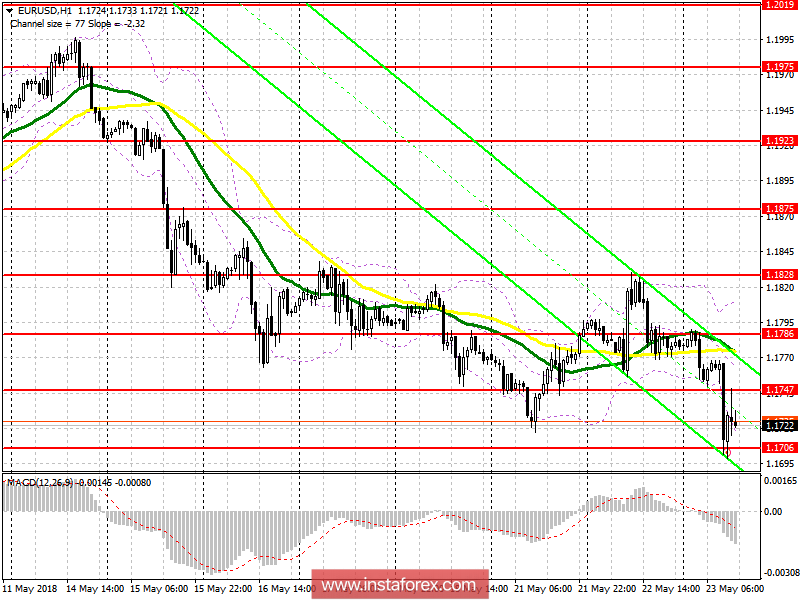

In the afternoon, attention was solely focused on the Fed's protocols. Purchases can be viewed after a failed breakdown and return to the morning support level of 1.1706 or on a rebound from the new monthly lows of 1.1673 and 1.1639. In the event of securing the euro above 1.1747 in the afternoon, you can expect to update the daily high in the area of 1.1786, where I recommend profit taking.

To open short positions for EURUSD, it is required:

As long as the trade is below 1.1747, the pressure on the euro will continue, and the re-test of support of 1.1706 may lead to a new wave of selling in the area of 1.1673 and 1.1639, where I recommend to lock in the profit. In case of growth above 1.1747 in the second half of the day, you can return to selling the euro to a rebound from the resistance of 1.1786.

Indicator description

- Moving Average (average sliding) 50 days - yellow

- Moving Average (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română