To open long positions for GBP/USD, it is required:

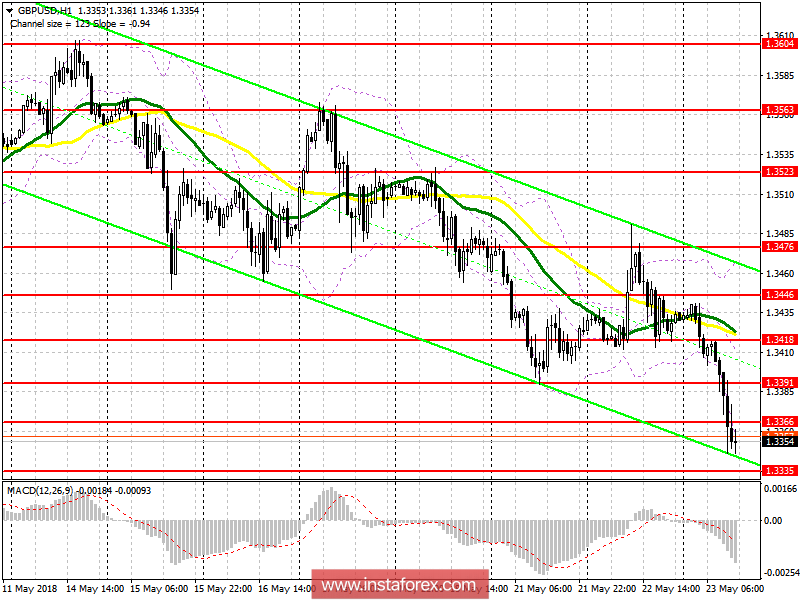

The pressure on the pound remained and it is better not to rush in buying the pound after the inflation data. Buyers can only expect the support area of 1.3335, but it is best to buy the pound on the rebound from the support of 1.3309. The main task for the second half of the day will be to return to the resistance of 1.3366 with the update of 1.3391, where I recommend to lock in the profit.

To open short positions for GBP/USD, it is required:

While the trade is below 1.3366, the pressure on the pound will remain, which will lead to the renewal of the morning target around 1.3335, and, quite possibly, towards the exit to a new monthly low in the area of 1.3309, where I recommend to lock in profit. If the pound is above 1.3366, you can consider selling from the resistance of 1.3391.

Indicator description

- Moving Average (average sliding) 50 days - yellow

- Moving Average (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română