D. Trump again demonstrates to the world his dissatisfaction with the way trade negotiations between the US and China are going on, as well as political negotiations with North Korea.

It seems that the American president is clearly not satisfied with the way the negotiation process between the US and China on the issue of trade duties and, in general, the topic of resolving trade contradictions. Watching him and the way he talks, you can only say one thing, he is only interested in the complete surrender of the enemy. This is observed both in the negotiation process with China and the DPRK. In assessing this, it can be stated with a high degree of certainty that the tension that was already asleep at the beginning of the week rises again, and only Trump is to blame, and no one else.

The US president wants to resolve many issues and problems that have been accumulating for decades, in a flash, in fact destabilizing not only the financial markets, but the world in general.

Yesterday's comment by the US Treasury, S. Mnuchin showed that the hopes for reaching agreements are illusory. In his comments, he said that "duties on the import of steel and aluminum will remain in force for China." With regard to the Chinese company ZTE, the States are in favor of maintaining a tough stance, while falsely claiming that this is by no means a non-competitive struggle. "As for ZTE, our goal was not to dislodge this company from the business, but to subject it to sanctions," said Mnuchin. In general, the speech of the US Treasury Secretary clearly indicates the desire of the United States to use force to reverse the situation both on the political plane and in the economic world.

All that is happening now indicates that high volatility will remain in world markets and that after a certain discharge a new wave of tension sets in. Protective assets have already responded to this growth in quotes. In the foreign exchange market, the Japanese yen sharply went up in the Asian trading session, and on the eve of the quotation of "black gold" again copied the local highs after the comment of the same Mnuchin, who, in addition to the topic of China, also touched upon the situation around Iran, saying that they would be applied against him both primary and secondary sanctions.

In assessing this state of affairs, we believe that the value of protective assets may continue to grow.

Forecast of the day:

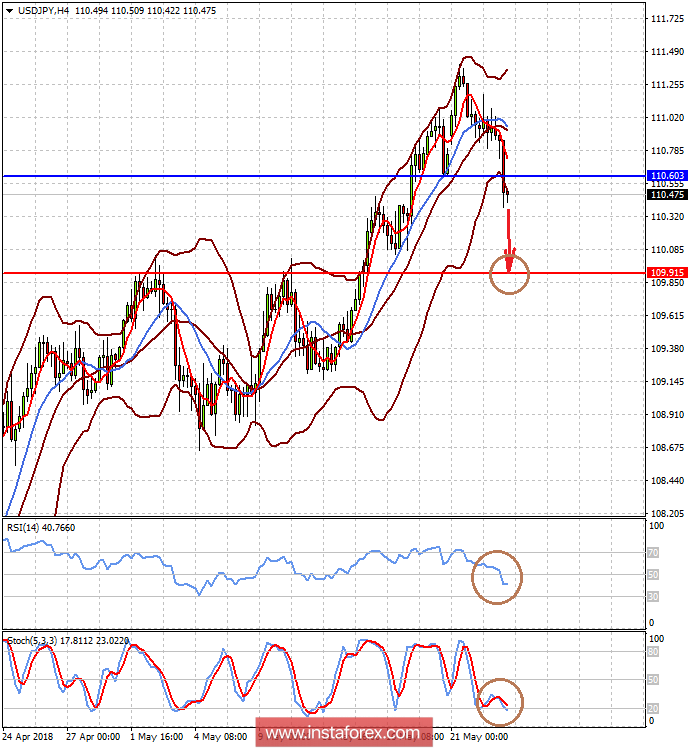

The currency pair USD / JPY fell sharply on the wave of growing geopolitical tensions in Asia. The price fell below the level of 110.60, which opens the way for it to decrease to 109.90, while tension will persist.

The currency pair USD / CAD remains in the range of 1.2750-1.2900. On the wave of correction of oil prices, as well as expectations that the protocol published today by the Fed will show the regulator's desire to further raise interest rates, the pair may continue to rise to 1.2900.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română