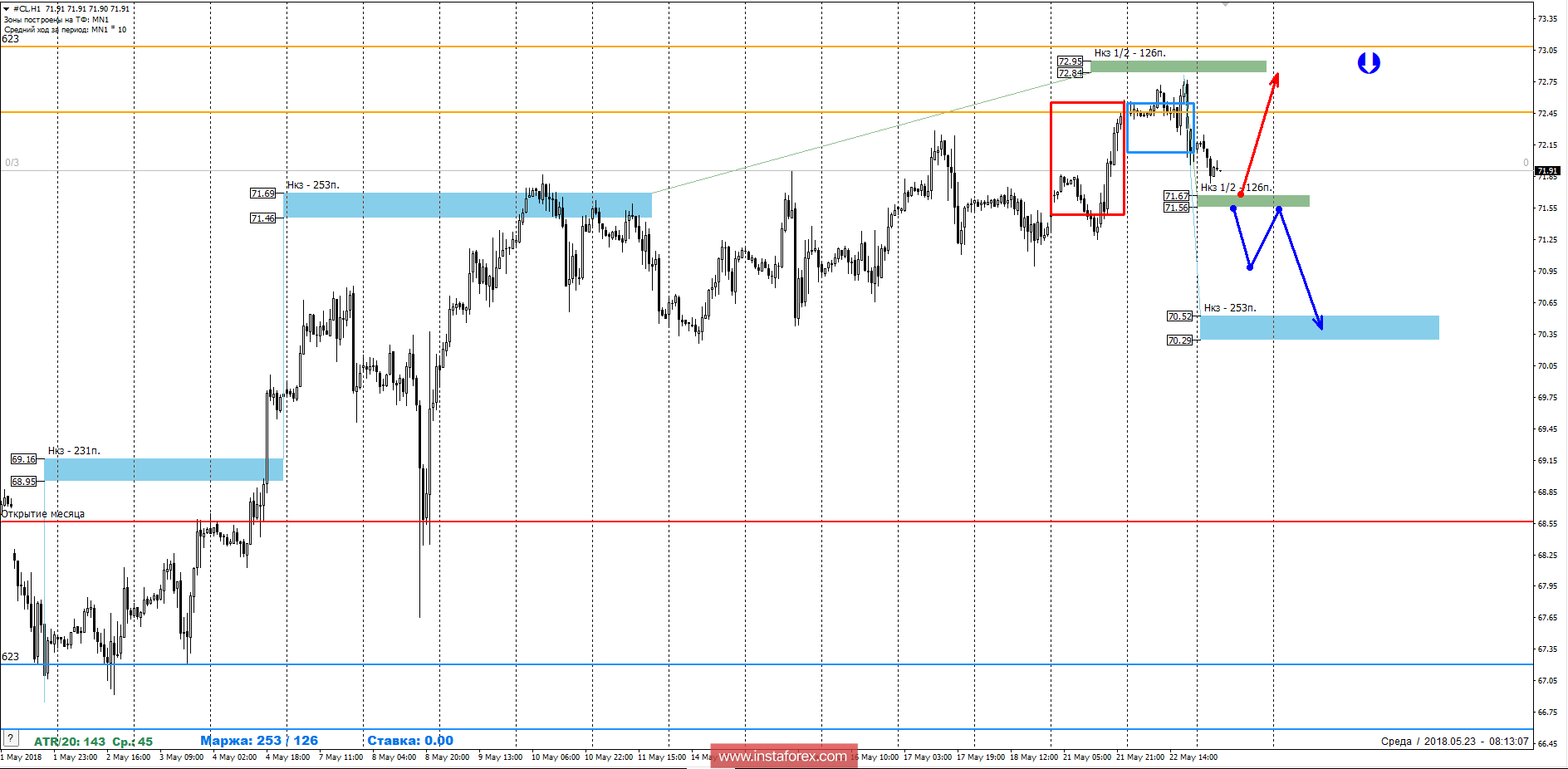

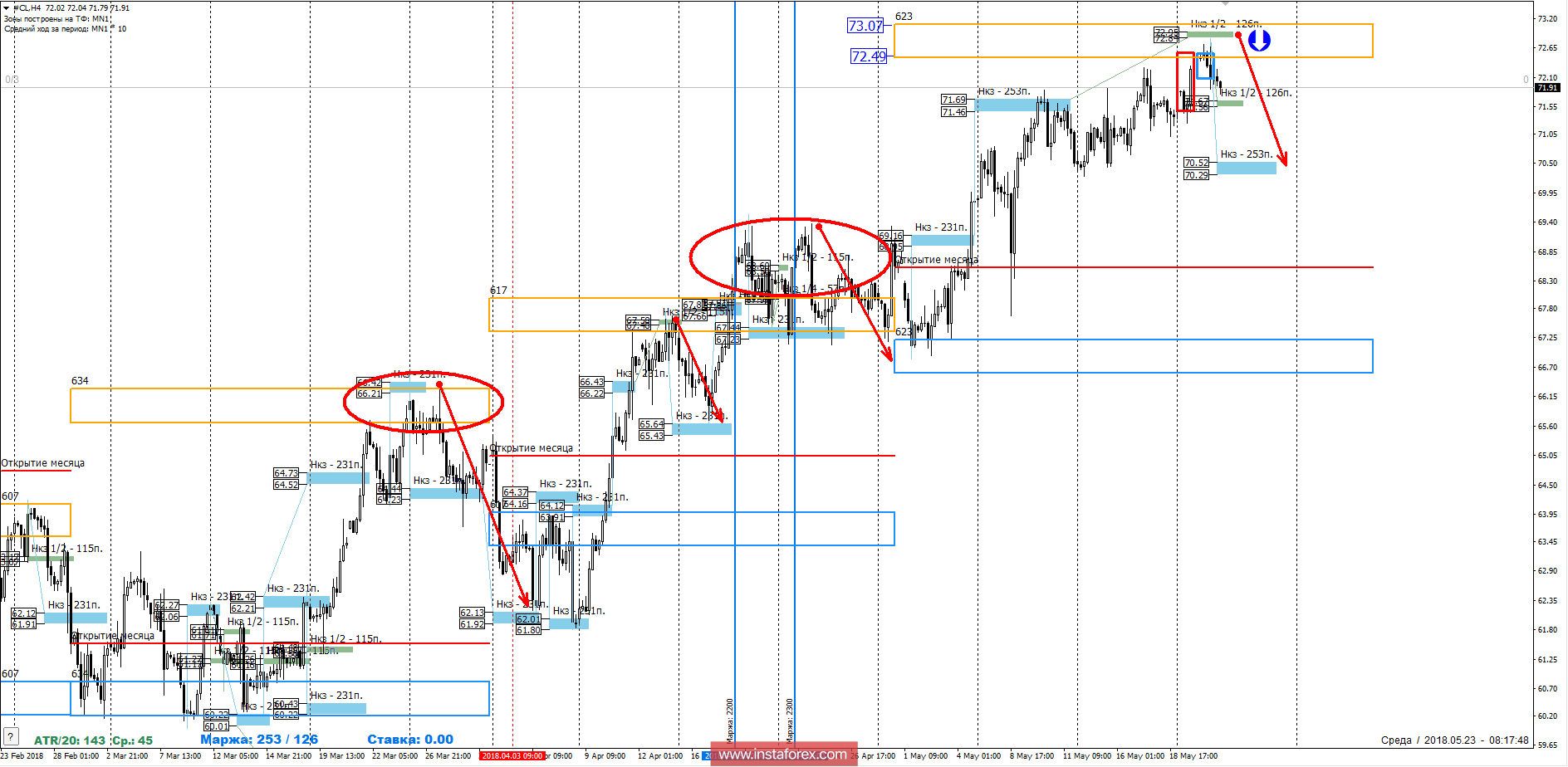

A protracted medium-term trend allowed testing the monthly short-term 73.07-72.49 this week. This obliges to close all long positions and consider the formation of a correctional model for the search for more favorable prices for the purchase of the instrument. It is important to note that within the monthly short-term there is an NCP 1/2 of 72.95-72.84, which makes the resistance more clear. Yesterday's decrease from a monthly short-term fault allows us to consider the NCP test 1/2 71.67-71.56 as determining for the upward movement. If the pair can today consolidate below this zone in the US session, then there will be the absorption of a two-day growth, which will result in the continuation of the decline by the week-long short-term 70.52-71.56. If the price is kept above the level of 71.56, the growth will resume to the weekly maximum.

The probability of course retention within its monthly average course (monthly short-term fault) is 70%, which allows you to consider corrective patterns for sale within its limits. When opening short trades, it is worth looking for fast fixations on the nearest support zones, NCP 1/2 and weekly short-term, which will allow you to quickly turn around during an upward impulse when the situation requires it. As an example of flat and corrective stratagems, it is worth considering the tests of the monthly control zones of April and March. The correction sizes can reach 200-400 points.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română