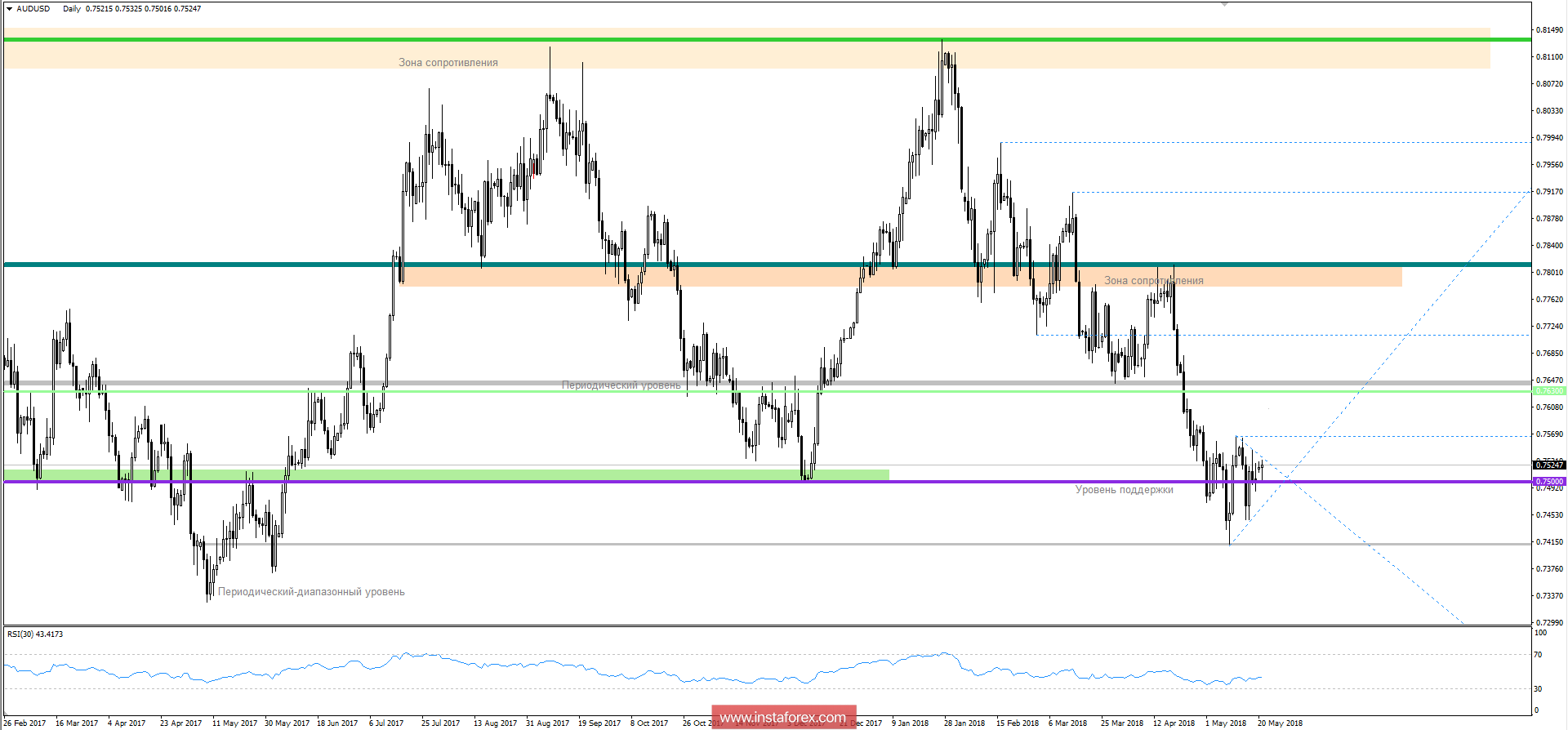

The AUDUSD currency pair continues to wobble near the 0.7500 level, drawing us the graphical model "Symmetrical triangle". Considering the graph earlier, we already discussed that the pair recently showed a fairly intense downward movement, where the level of 0.7500 stood before the quotation, reflecting support for the formation of correction. But, as we see, by the result of the "tanks" and did not manage to deploy the quotation, we just returned back to the level of 0.75. Now the waver amplitude decreases, where we see the formation of two-valued candles of the "doji" type and the general drawing of the "Triangle symmetrical" graphic model. It is possible to assume further concentration near this level, but in case of consolidation below 0.7460, new values of 0.7320/0.7150 may be opened.

At the same time, traders should not forget long positions, the dollar is overbought on all fronts, a correction has been discussed for a long time on it, but when this moment will come, it's impossible to say, but you need to be ready for it. For me personally, the point of a possible fracture of interest is 0.7570 (the fixation is above it).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română