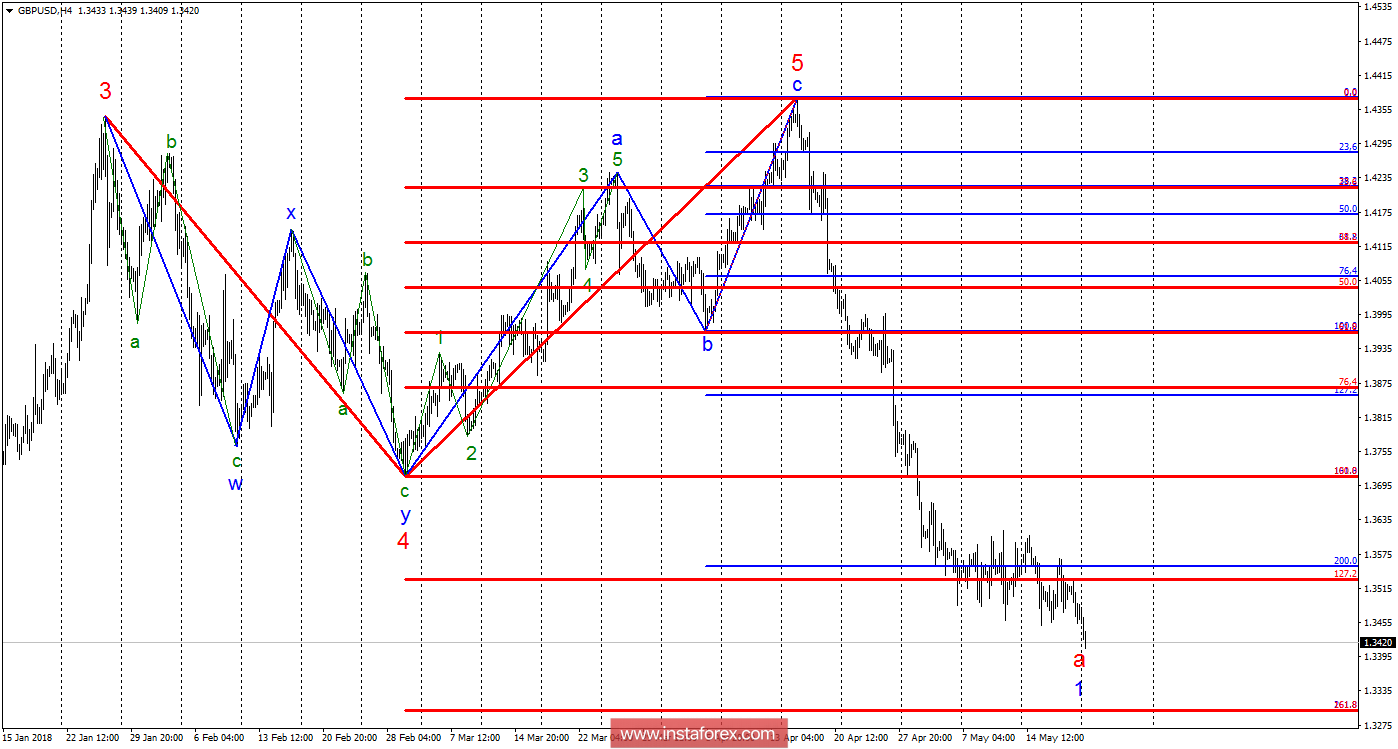

Analysis of wave counting:

For several weeks, the British pound consolidated along the 200.0% mark on the junior Fibonacci grid and 127.2% on the senior grid. On Friday trading, the instrument resumed lowering of quotations, according to the construction of the first wave of a new and strong downward set of waves. Presumably, the instrument is in the stage of building wave a, in the future 1. The news background and the popularity of the American currency in the last month do not provide an opportunity for constructing a correctional wave b.

The objectives for the option with purchases:

1.3528 - 127.2% of the Fibonacci of the highest order

1.3555 - 200.0% of Fibonacci

The objectives for the option with sales:

1.3300 - 161.8% of the Fibonacci of the highest order

1.3300 - 261.8% of Fibonacci

General conclusions and trading recommendations:

The tool continues to complicate the internal wave structure of the assumed wave a, 1 downward trend section. I recommend selling the pair with a target located near the estimated mark of 1.3300, which corresponds to 161.8% and 261.8% of Fibonacci. An unsuccessful attempt to break this strong level will warn about the readiness of the instrument to build an upward correction wave b and will serve as a good signal for closing sales and forming small purchases with the targets of 1.3528 and 1.3555.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română