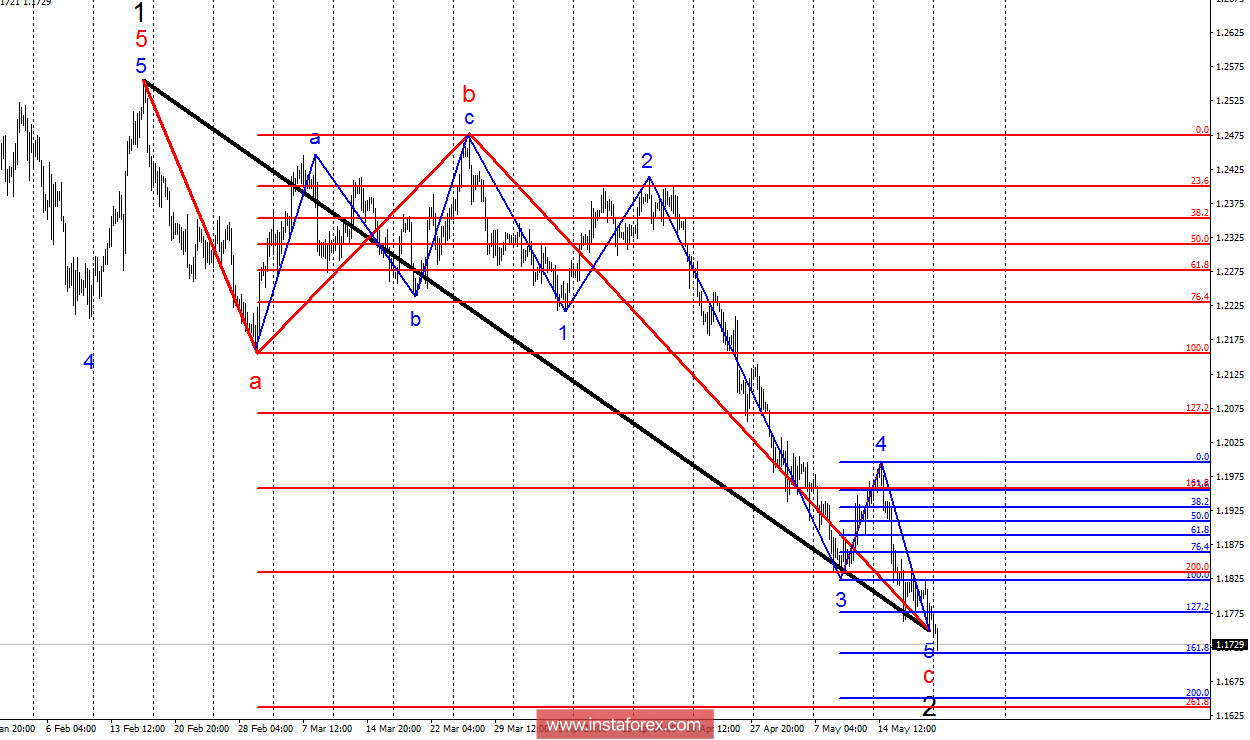

Analysis of wave counting:

The five-wave structure in the composition of wave c, 2, looks quite complete. Based on the size of wave 4, c, 2, 5, the downward pulse can continue its construction to Fibonacci levels of 161.8% and 200.0%. Also practicing the proportionality of 1.618 between waves b, c, 2, the tool can continue the decline to the level of 1.1636. At the moment, 1.1636 looks like an extreme minimum point for the entire downward trend segment, which starts on March 27. Only high demand for the US dollar can lead to an even more complicated and lengthening of the wave 5, c, 2.

The objectives for the option with sales:

1.1715 - 161.8% of Fibonacci

1.1649 - 200.0% of Fibonacci

1.1636 - 261.8% of the Fibonacci of the highest order

The objectives for the option with purchases:

1.1835 - 200.0% of the Fibonacci of the highest order

General conclusions and trading recommendations:

The proposed wave 5, c, 2 continues its construction. Therefore, it is recommended to sell the pair with targets located near the calculated marks of 1.1715 and 1.1649. Given the strength of the downtrend, wave 5 can take a more complex look, and the tool continues to fall below the 1.1636 mark, which equates to 261.8%. An unsuccessful attempt to break the zone of 1.1649 - 1.1636 will allow the completion of the construction of the wave c, 2 and begin to form purchases.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română