To open long positions on EURUSD it is required:

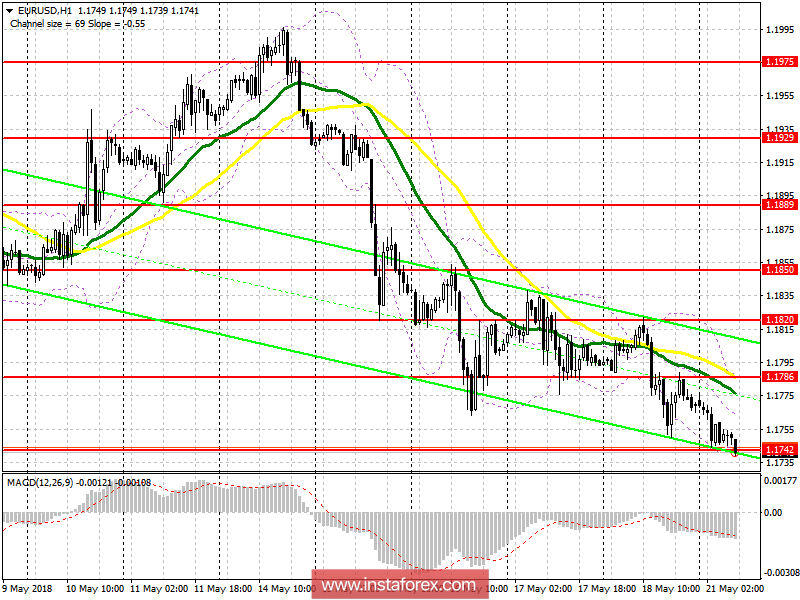

To consider buying the euro today is best after the return and consolidation at 1.1742 resistance level, which will lead to an upward correction to the area 1.1786 and 1.1820, where it is recommended fixing the profit. In the case of a further decline in the euro, it is recommended to open long positions in the formation of a false breakout in the support area 1.1710 or on a rebound from 1.1683.

To open short positions on EURUSD it is required:

While the trade is below 1.1742, the pressure on the euro will continue, and the main target of the sellers to date will be large support levels in the area of 1.1710 and 1.1683, where it is recommended fixing profits. In the event of a EUR/USD returning to 1.1742 in the morning, return to selling is best on a rebound from resistance at 1.1786.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română