To open long positions for EUR / USD, you need:

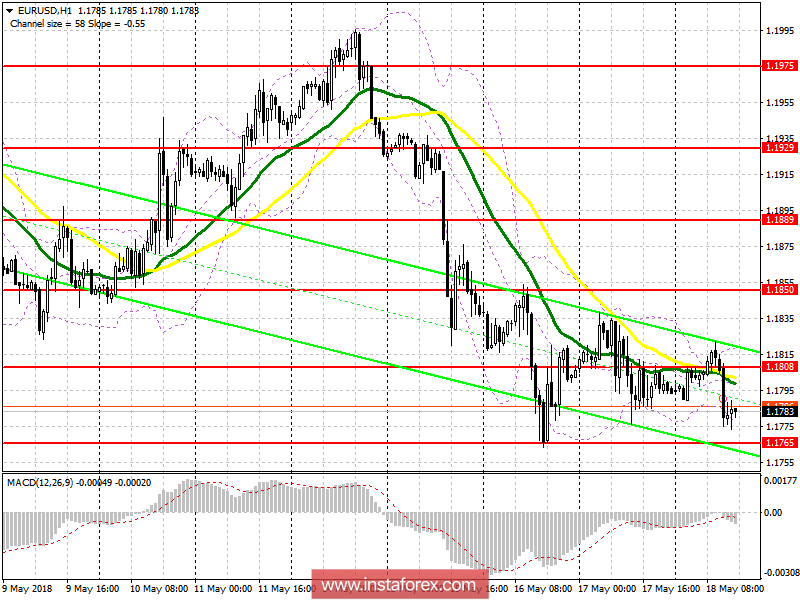

To buy the euro in the second half of the day, it is best to return after updating the lows of the month around 1.1765 and forming a false breakdown there, or to rebound from the support level of 1.1745. The main task of buyers will be to return to the resistance level of 1.1808, which will allow us to expect a larger upward correction to the area of 1.1805.

To open short positions for EUR / USD, you need:

While the trade is below 1.1808, the pressure on the euro will continue, and an unsuccessful attempt to consolidate above this range will serve as a good signal for the opening of short positions, with a view to reducing the month to the low of 1.1765 and updating it in areas 1.1742 and 1.1710, where I recommend fixing the profits. Otherwise, you can sell the euro on a rebound from 1.1850.

Description of indicators

MA (average sliding) 50 days - yellow

MA (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA

Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română