EUR / USD

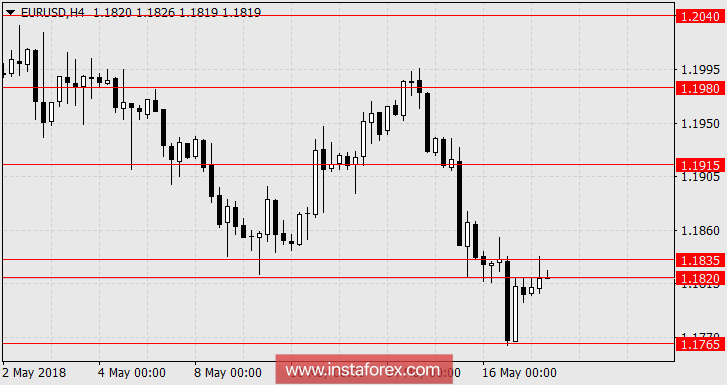

On Wednesday, an unexpected and somewhat provocative information about the initiative of the Italian "League of the North" to appeal to the ECB with a proposal to write off the public debt of 250 billion euros broke into the market, after which to leave Italy from the European Union. Of course, none of the parliamentary parties of Italy has ever voiced such ideas officially, but the American media took advantage of the time-out until next week in Italy's negotiation process to form a coalition government and allowed big players to record profits on previously open dollar purchases. But the "League of the North" put forward a proposal to cancel the agreement on financial stability, since it is practically not being executed. But against the backdrop of a new wave of discussions of a single banking union, this looks harsh. As a result, the euro yesterday lost 31 points (a decrease of 73 points in the moment) and today, in the Asian session, it almost played this fall.

Macroeconomic data, primarily in the US, came out mixed. If the European CPI remained unchanged in April (1.2% y / y and the base CPI 0.7% y / y), then in the US the number of new home builds in April showed a decrease from 1.34 mln (revised from 1.32 million) to 1.29 million (forecast 1.32 million), and industrial production growth for April increased by 0.7% against expectations of 0.6%. And there was a small nuance here, March Industrial Production was revised from 0.5% to 0.7%, which was reflected in the adjustment of capacity utilization. Against the forecast of an increase to 78.4%, the load was only 78.0%. Still, the number of issued building permits in March was revised from 1.35 million to 1.37 million, and the April indicator showed 1.352 million against the forecast of 1.347 million.

Crude oil reserves in the United States decreased by 1.40 million barrels, which helped oil grow by 0.32% and helped with corrective growth this morning. And if the correction has begun, then it can continue on a favorable general background. Italian parties have managed to refute reports of their nonexistent initiatives, and today at 09:00 London time, Italy's trade balance will be published for March, the forecast for which is 3.74 billion euro against the February figure of 3.10 billion. In the US, the index of business activity in the manufacturing sector of Philadelphia is expected to decline from 23.2 to 21.1 in May, and the forecast for the weekly report on the number of applications for unemployment benefits is 216 thousand versus 211 thousand a week earlier.

How long the correction for time and depth will last is difficult to guess, much will depend on the decision of Italian President Sergio Mattarella on the date of the re-election and the composition of the interim government. Perhaps this will be level 1.1915.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română