On Wednesday, the currency market showed high volatility on the first wave of small correction in the yield of government bonds of the U.S. Treasury and then resumed its growth. The dollar also traded unevenly and received support in the morning. However, the opening of trading in the U.S. puts it under pressure.

The dynamics of the yield of government bonds in the United States at the moment is an important factor for the world financial markets, as it determines the future redistribution of capital that has "stayed" in government bonds amid low interest rates and weak inflationary pressures that prevailed in the United States almost a decade after the beginning of the mortgage crisis in the year 2007.

On Tuesday, the yield of 10-year Treasuries rose sharply, consolidating above the 3.0% level at 3.070%. On Wednesday, after a slight correction before the start of trading in the US, it resumed the rise adding a level of over 3.080% as of the moment. In our view, the growth in yields will continue, as the Fed will continue to raise interest rates, which were signaled by some Fed members to the media.

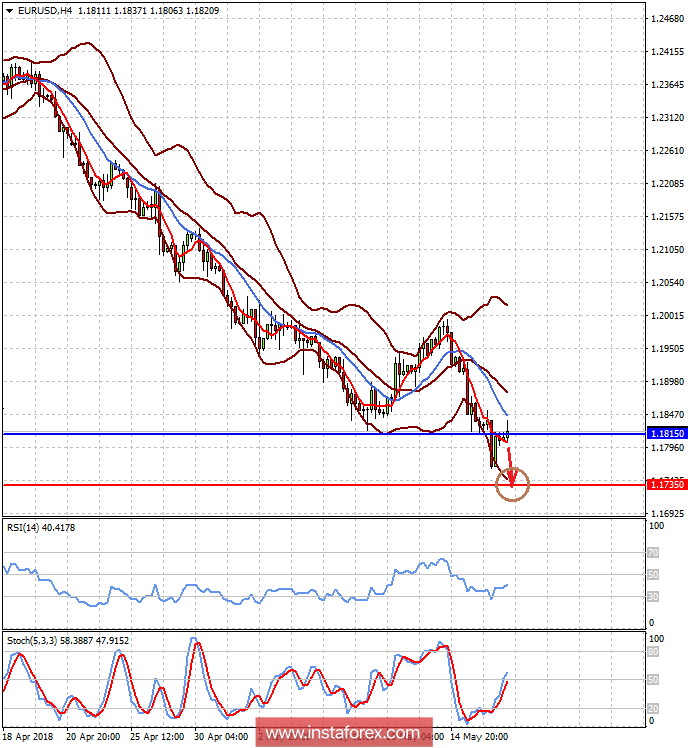

The published data of economic statistics from the eurozone on consumer inflation has shown once again the absence of an increase in inflationary pressure, which will put downward pressure on the single currency. In accordance with the published data, the CPI added only 0.3% in April, which was in line with expectations but it was significantly below 1.0% in March. On an annualized basis, consumer inflation maintained its growth rate unchanged at 1.2%.

Against the background of the data, the EUR/USD has sharply begun to decline and although it played almost half of the losses, it still remained under pressure. This behavior can be explained by the drop in expectations of the markets in ending ECB's stimulus measures in September this year. In 2019, it will begin the process of raising interest rates.

Assessing the emerging general moods on world markets, we believe that the dollar's growth will continue and its main supporting factor will be the upward dynamics of yields on U.S. Treasury bonds.

Forecast of the day:

The EUR/USD pair remains in the short-term downtrend, which will most likely be on the Treasury yield's wave of growth and discrepancy in the monetary policies of the ECB. The pair will continue its decline to 1.1735.

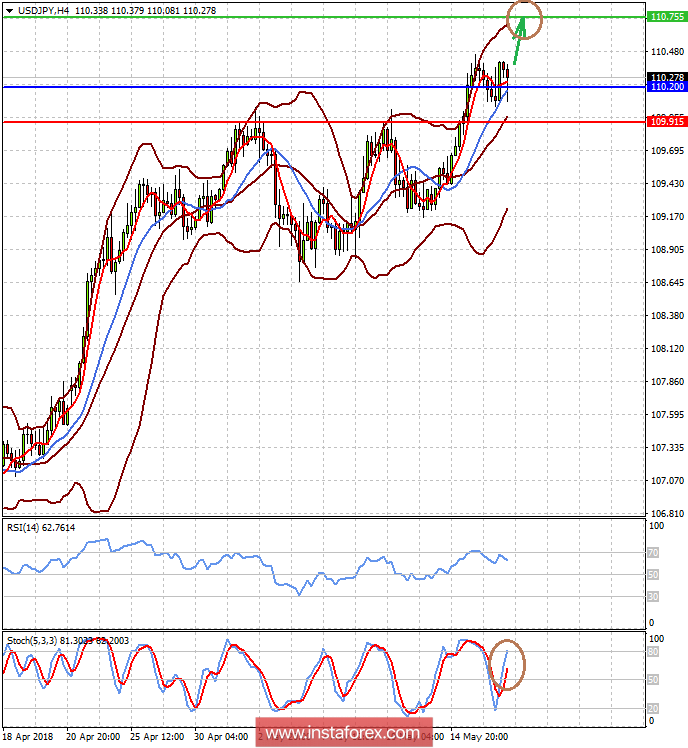

The USD/JPY pair is above the level of 110.20. Continuation of the dollar's rally can support the pair and promote its growth to 110.75.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română